loginjoker123.ru

Tools

What Is The Federal Income Tax Rate For Retirees

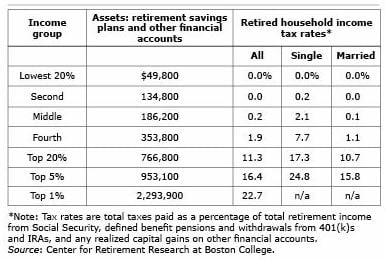

Between $25, and $34,, you may have to pay income tax on up to 50% of your benefits. More than $34,, up to 85% of your benefits may be taxable. File a. Pennsylvania charges personal income tax at a flat rate of percent. Retirement income is not taxed in Pennsylvania as long as plan requirements are met. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free. Long-term investment gains, including qualified. Retirement and pension benefits include most income that is reported on Form R for federal tax purposes. This includes defined benefit pensions, IRA. About 92 percent of the Social Security benefits subject to Minnesota income tax is earned by taxpayers with at least $50, of federal adjusted gross income . Annuities. Annuity income is at least partially taxable and, in some cases, may be fully taxable. · Pensions · Capital gains and dividends · Life insurance cash. If you receive pension or annuity payments before age 59½, you may be subject to an additional 10% tax on early distributions, unless the distribution qualifies. Monthly benefits from KERS, CERS, and SPRS are subject to federal income tax. If a member made contributions with after-tax dollars, then a portion of the. Resources to help NYSLRS retirees with a variety of tax related topics, including R forms and federal tax withholding. Between $25, and $34,, you may have to pay income tax on up to 50% of your benefits. More than $34,, up to 85% of your benefits may be taxable. File a. Pennsylvania charges personal income tax at a flat rate of percent. Retirement income is not taxed in Pennsylvania as long as plan requirements are met. Social Security income is taxed at your ordinary income rate up to 85% of your benefits; the rest is tax-free. Long-term investment gains, including qualified. Retirement and pension benefits include most income that is reported on Form R for federal tax purposes. This includes defined benefit pensions, IRA. About 92 percent of the Social Security benefits subject to Minnesota income tax is earned by taxpayers with at least $50, of federal adjusted gross income . Annuities. Annuity income is at least partially taxable and, in some cases, may be fully taxable. · Pensions · Capital gains and dividends · Life insurance cash. If you receive pension or annuity payments before age 59½, you may be subject to an additional 10% tax on early distributions, unless the distribution qualifies. Monthly benefits from KERS, CERS, and SPRS are subject to federal income tax. If a member made contributions with after-tax dollars, then a portion of the. Resources to help NYSLRS retirees with a variety of tax related topics, including R forms and federal tax withholding.

Taxpayers who are 65 years of age or older as of the last day of the tax year can subtract the smaller of $24, or the taxable pension/annuity income included. Annuities. Annuity income is at least partially taxable and, in some cases, may be fully taxable. · Pensions · Capital gains and dividends · Life insurance cash. Retirement income isn't taxed in 13 states — meaning you can avoid paying Uncle Sam on distributions from your (k), IRA and pension payouts. Retirement on the Federal return are exempt from Georgia Income Tax. The pensions, annuities, and the first $ of earned income. Earned. Sales of Stocks, Bonds, and Mutual Funds: Long-term gains (held over a year) are taxed at 0%, 15%, or 20% capital gains tax rates, based on income thresholds. Military pensions, Social Security & Railroad benefits continue to be exempt from tax. Rollovers not included in the Federal Adjusted Gross Income (AGI) will. The exemption reduces a taxpayer's Vermont taxable income before state tax rates are applied. IRS VITA/TCE Free tax assistance for seniors and lower-income. If you choose to have the payment made to you and it is over $, it is subject to the 20 percent federal income tax withholding. The payment is taxed in the. taxable and may not be subtracted from federal income. Military and uniformed services retirement benefits are not taxable for Wisconsin income tax purposes. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Generally speaking, retirees' taxable income sources will fall under one of two federal tax categories: Ordinary income, which is taxed from 10% to 37% and. Retirees in New York should have relatively low income tax bills. On the other hand, the state's average state and local sales tax rate is % and property. (k), (b), and other qualified workplace retirement plans: Plan providers typically withhold 20% on taxable distributions—unless the withdrawal is made to. NYCERS' benefit payments (monthly retirement allowances, loans and excess refunds) are subject to Federal taxes, but are exempt from. New York State and local. Information updated 2/24/ State, Income Tax, Tax NY Pension, Tax IRC 's or. Deferred Comp. Even for retirement income that is subject to state income tax, the highest rate you will pay is %. Tax on Taxable Income: Low of 0% (on up to $44, for. income from real property and qualified retirement plans (IRS Sec. ) The maximum income tax rate is % on income of $60, or over. Refund. If you included income sources for both you and your spouse, enter your combined estimated taxes and expenses below. Federal income tax rate. Social Security income is not taxed. Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is. Learn more about taxes and federal retirement We are required by law to update your federal income tax withholding based on the IRS tax tables and formulas.

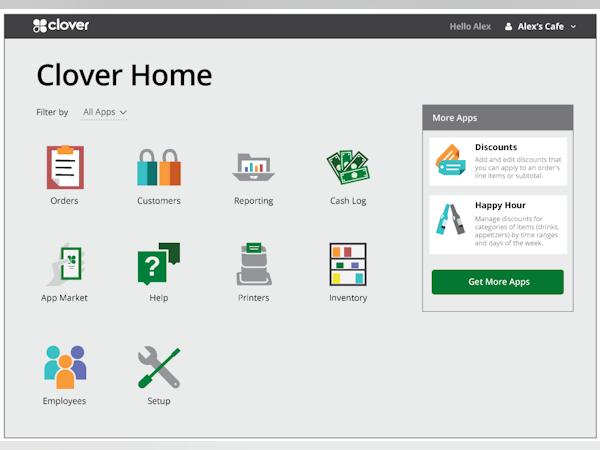

Clover Monthly Cost

After the day trial period, the cost for Virtual Terminal is $ per month when no other software plan is in effect. Trial period and monthly cost is. Register - $ for 1st device $ per additional device per business location. Full Clover retail software with processing. Payments. Flex lets you accept. Clover, Square ; Monthly software fees, Plans start at $, up to $ per month. Plans start at $0, up to $60 per month, custom pricing plans available. Using Clover's flat-rate model, the store might pay a % fee plus a $ per transaction fee. Over a month, this would amount to approximately $ in. Requires a 3-year contract. When applying for the Clover Account experience without hardware, the monthly software fee is waived for 90 days. After the day. Digitally accept checks with low processing costs, fast payment processing, no monthly minimum, and peace of mind from TeleCheck's powerful warranty protection. Clover Monthly Service Plans · Payments Plus – $/month · Register Lite Plan – $/month · Register Plan – $/month · Clover Plan Comparisons. Costs range from $49 for a basic Clover Go handheld card reader to $1, plus $ per month for a Clover Station Duo with a receipt printer. Kiosks, kitchen. Keep your business running with contactless payments and curbside pickup. Clover Flex now available for $ per month* for a limited time only. Call us at . After the day trial period, the cost for Virtual Terminal is $ per month when no other software plan is in effect. Trial period and monthly cost is. Register - $ for 1st device $ per additional device per business location. Full Clover retail software with processing. Payments. Flex lets you accept. Clover, Square ; Monthly software fees, Plans start at $, up to $ per month. Plans start at $0, up to $60 per month, custom pricing plans available. Using Clover's flat-rate model, the store might pay a % fee plus a $ per transaction fee. Over a month, this would amount to approximately $ in. Requires a 3-year contract. When applying for the Clover Account experience without hardware, the monthly software fee is waived for 90 days. After the day. Digitally accept checks with low processing costs, fast payment processing, no monthly minimum, and peace of mind from TeleCheck's powerful warranty protection. Clover Monthly Service Plans · Payments Plus – $/month · Register Lite Plan – $/month · Register Plan – $/month · Clover Plan Comparisons. Costs range from $49 for a basic Clover Go handheld card reader to $1, plus $ per month for a Clover Station Duo with a receipt printer. Kiosks, kitchen. Keep your business running with contactless payments and curbside pickup. Clover Flex now available for $ per month* for a limited time only. Call us at .

With any plan, Clover offers no monthly fee for the first 30 days. All plans let you accept credit and debit cards (magstripe, EMV chip, and NFC contactless. Experience the power of the Clover Duo terminal with no extra costs or hidden fees, making it an affordable choice for businesses looking to enhance their. For example, a basic Clover Go handheld card reader costs $49, while a Clover Station Duo is $1, There are also various add-ons, including payroll. Clover takes a combination fee from businesses who run their Clover POS with Online Ordering added. This means a flat monthly fee (from $60 to $) and a per-. Clover Products ; Clover Station. $1, ; Clover Flex Special. $ ; Clover Go. $ ; Clover Flex. $ ; Clover Station Bundle. $ Payment processing costs · Clover's entry-level Payments software is included in the monthly service fee for the first device; $ per month for each. When applying for the Clover Account experience without hardware, the monthly software fee is waived for 90 days. Trial period and monthly cost is subject to. The Register plan costs $/month for the first device and then just $ for each additional device thereafter + processing fees. 4. Counter Service. By comparison a Clover Flex* costs $ (payment processing fee is % + 10¢). Monthly fees for hardware vary by plan. With Square for Restaurants, pay $40 per. Clover is a POS system that has costs involved on the software side. I believe it starts at $49 per month and goes up from there. If all you are. Clover Products ; Clover Station. $1, $1, ; Clover Flex Special. $ $ ; Clover Go. $ $ By comparison a Clover Flex* costs $ (payment processing fee is % + 10¢). Monthly fees for hardware vary by plan. With Square for Restaurants, pay $40 per. Experience the power of the Clover Duo terminal with no extra costs or hidden fees, making it an affordable choice for businesses looking to enhance their. Clover POS included With your membership starting from $ Fixed monthly price; Keep % of your profits! No fees, no gimmicks. Limit One Unit per customer at discounted price. For New Merchant Account Call () 24/7 Support Call () As low as $ per month *. Register - $ for 1st device $ per additional device per business location. Full Clover retail software with processing. Full Register includes;. All the system, none of the price Clover starts at just $/month for the Flex and Mini when you use the Payments Plus plan. Clover Service Plans. Payment processing costs · Clover's entry-level Payments software is included in the monthly service fee for the first device; $ per month for each. 1. Interchange fees · 2. Markup fee · 3. Assessment fees · 4. Terminal fees · 5. Payment gateway fees · 6. Annual fee · 7. Monthly fee · 8. PCI compliance fee.

How To Cure Red Lips Fast

Bruises, blisters, or swelling on the lips caused by injury may be treated by sucking on ice pops or ice cubes. They can also be treated by applying a cold pack. Made with Vaseline® Jelly, it helps heal and prevent dry lips by locking in moisture. It provides long-lasting moisturization while adding a light rosy. Do · use a lip balm containing petroleum jelly or beeswax – you can buy these at a pharmacy or supermarket · try a few different lip balms if one is not working. Lips Pink Fresh Fast Lightening Bleaching Cream Balm Treatment Remove Dark Lips Ordered white & red, sent in same pkg, easily ID'd (Red have red insulation. The best thing to do if you have dry or sore lips is to regularly apply a lip balm containing petroleum or beeswax. Regardless of the dark pigmentation cause, everyone can benefit from non-invasive Laser Lip Lightening. It gives you fast and lasting results. What is Laser Lip. Cuts to the lip usually heal quickly. But your lip may be sore while it Red streaks leading from the cut. Pus draining from the cut. A fever. Watch. Products with feel-good formulas can leave lips feeling smooth, soft, and supple, like the Artistry Studio™ Pampered Pout Lip Balm + Overnight Mask. Made with. Home Remedies For Pink Lips ; 1. Coconut Oil · Dip your index finger in a cup of Extra Virgin Coconut Oil and swipe it on your lips. · Allow it to dry naturally. Bruises, blisters, or swelling on the lips caused by injury may be treated by sucking on ice pops or ice cubes. They can also be treated by applying a cold pack. Made with Vaseline® Jelly, it helps heal and prevent dry lips by locking in moisture. It provides long-lasting moisturization while adding a light rosy. Do · use a lip balm containing petroleum jelly or beeswax – you can buy these at a pharmacy or supermarket · try a few different lip balms if one is not working. Lips Pink Fresh Fast Lightening Bleaching Cream Balm Treatment Remove Dark Lips Ordered white & red, sent in same pkg, easily ID'd (Red have red insulation. The best thing to do if you have dry or sore lips is to regularly apply a lip balm containing petroleum or beeswax. Regardless of the dark pigmentation cause, everyone can benefit from non-invasive Laser Lip Lightening. It gives you fast and lasting results. What is Laser Lip. Cuts to the lip usually heal quickly. But your lip may be sore while it Red streaks leading from the cut. Pus draining from the cut. A fever. Watch. Products with feel-good formulas can leave lips feeling smooth, soft, and supple, like the Artistry Studio™ Pampered Pout Lip Balm + Overnight Mask. Made with. Home Remedies For Pink Lips ; 1. Coconut Oil · Dip your index finger in a cup of Extra Virgin Coconut Oil and swipe it on your lips. · Allow it to dry naturally.

Vaseline or cocoa butter - apply just before bed, and during the day if needed. My lips haven't been chapped or dry since. Apply a lip balm with sunscreen in it. This will prevent your lips from drying, cracking or changing colour. Cover your face with a scarf when exposed to the. Apply a non-irritating lip balm (or lip moisturizer) several times a day and before bed. If your lips are very dry and cracked, try a thick ointment, such as. To get rid of redness on the top of your lip, you can try using a cold compress, applying aloe vera gel, or using a gentle exfoliator to. Home remedies to make your lips red/pink permanently · Cut the beetroot and rub it on your lips times a day. · Apply DIY homemade beetroot lip balm daily. Do · use a lip balm containing petroleum jelly or beeswax – you can buy these at a pharmacy or supermarket · try a few different lip balms if one is not working. Regardless of the dark pigmentation cause, everyone can benefit from non-invasive Laser Lip Lightening. It gives you fast and lasting results. What is Laser Lip. Stay Hydrated: Drinking plenty of water can help keep the body hydrated and aid in reducing lip swelling caused by dehydration or allergic reactions on lips. Skin redness or inflammation that gets bigger as the infection spreads; Skin sore or rash that starts suddenly, and grows quickly in the first 24 hours; Tight. Swelling around the eyes or lips; Hives; Paleness; Weakness; A fast heart beat or dizziness. Life threatening allergic reactions to the flu shot are rare. These. Take some beetroot juice and apply it on your lips before sleeping at night. Leave it on your lips overnight. Wash your lips in the morning and apply lip balm. Consult the medication dictionary to quickly obtain detailed information. All Your blood makes your lips look red (or blue). The skin on your lips. Burt's Bees Overnight Intensive Lip Treatment, oz - Moi Ounce (Pack of 1). (). $ dry, red cracked lips; a swollen, bumpy, red tongue (“strawberry tongue”); red After a few weeks, and with the correct treatment, the symptoms become less. Cracked, Painful Lips Could Be Angular Cheilitis — Here's How to Treat It · Angular cheilitis is a skin condition that causes painful cracks at one or both. Home Remedies For Pink Lips · 1. Lemon: In a study conducted in , researchers identified that the lemon peel was found to effectively stop melanin production. NEOSPORIN LIP HEALTH® Overnight Renewal Therapy® is clinically proven to restore visibly healthier lips in 3 days. A unique combination of antioxidants and. Your lips have a fabulous blood supply, so once you're applying the right cream, they can heal up very quickly (even overnight!). Angular cheilitis vs. cold. Unscented and unflavored lip balms, like petroleum jelly or virgin coconut oil heal the infection and are an excellent natural treatment for angular cheilitis. dry, red cracked lips; a swollen, bumpy, red tongue (“strawberry tongue”); red After a few weeks, and with the correct treatment, the symptoms become less.

Ltv Formula Real Estate

Real estate. Explore all mortgages resources. Mortgages. Compare rates. Mortgage Loan-To-Value Calculator. Whether you're wondering if you have enough. It's used as one indicator of the risk a particular mortgage represents to the lender. Loan-to-value ratio formula. To calculate LTV, use this equation. Learn how to determine and calculate the equity in your home and your loan-to-value ratio (LTV) before considering refinancing or borrowing from your home's. 1. What is the formula to determine loan-to-value ratio? · Mortgage amount / appraised property value · Appraised property value * length of mortgage · Mortgage. LTV represents the proportion of an asset that is being debt-financed. It's calculated as (Loan Amount / Asset Value) * LTVs tend to be higher for assets. Depending on the credit score of the borrower and the local real estate market lenders will typically allow borrowers to access anywhere from 80% to 90% of. The loan-to-value is calculated by taking the amount of the loan (mortgage) and dividing it by the fair market value (FMV) of the property. The value of the. The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. In real estate. How to Calculate the Loan-to-Value Ratio We remove the barriers between borrowers and the right financing. So, for example, if the owner of an office asset. Real estate. Explore all mortgages resources. Mortgages. Compare rates. Mortgage Loan-To-Value Calculator. Whether you're wondering if you have enough. It's used as one indicator of the risk a particular mortgage represents to the lender. Loan-to-value ratio formula. To calculate LTV, use this equation. Learn how to determine and calculate the equity in your home and your loan-to-value ratio (LTV) before considering refinancing or borrowing from your home's. 1. What is the formula to determine loan-to-value ratio? · Mortgage amount / appraised property value · Appraised property value * length of mortgage · Mortgage. LTV represents the proportion of an asset that is being debt-financed. It's calculated as (Loan Amount / Asset Value) * LTVs tend to be higher for assets. Depending on the credit score of the borrower and the local real estate market lenders will typically allow borrowers to access anywhere from 80% to 90% of. The loan-to-value is calculated by taking the amount of the loan (mortgage) and dividing it by the fair market value (FMV) of the property. The value of the. The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. In real estate. How to Calculate the Loan-to-Value Ratio We remove the barriers between borrowers and the right financing. So, for example, if the owner of an office asset.

What is LTV? In real estate, a loan-to-value (LTV) is the ratio of a loan amount to an asset's value. In a exchange, your desired LTV will vary based. Basic Customer LTV Formula · Average Value of Sale = (Total Annual Sales Revenue) / (Total Annual Number of Orders) · Average Number of Transactions = (Total. Simply put, the formula to calculate the loan-to-value ratio (LTV) is the loan amount divided by the current appraised property value, expressed as a percentage. The loan-to-value ratio (LTV) looks at the market value of your assets to to calculate the maximum amount you can obtain through a secured loan. LTV represents the proportion of an asset that is being debt-financed. It's calculated as (Loan Amount / Asset Value) * LTVs tend to be higher for assets. Learn how to determine and calculate the equity in your home and your loan-to-value ratio (LTV) before considering refinancing or borrowing from your home's. The loan-to-value (LTV) ratio is a measure comparing the amount of your mortgage with the appraised value of the property. The higher your down payment. Real estate. Explore all mortgages resources. Mortgages. Compare rates. Mortgage Loan-To-Value Calculator. Whether you're wondering if you have enough. Basic Customer LTV Formula · Average Value of Sale = (Total Annual Sales Revenue) / (Total Annual Number of Orders) · Average Number of Transactions = (Total. The ratio of a loan to the value of an asset as determined by the formula Get Tips For Managing Real Estate Wealth. Learn Ways To Help Build Long-Term. In commercial real estate investing, LTV ratios for senior debt on a property investment typically range between 65% to 80% depending on the property type. Use this calculator to determine your LTV ratio, which expresses the percent of your home's value that's covered by your loan. What is the formula for calculating the loan-to value ratio? To calculate the loan-to-value ratio, divide the amount of the loan being requested by the market. The higher your LTV ratio, the more risky your loan will look to a lender — and the more expensive it will likely be for you. Lenders use your LTV ratio to. *On a purchase transaction for a residential property, the LTV is calculated using the lesser of either the purchase price or appraised value. For Example. In commercial real estate, a loan-to-value (LTV) ratio tells you how much of a property's value you're borrowing to finance your investment. Divide the original loan amount by the property value. (The property value is the current appraised value.) Manual and DU, Co-op share loans, See Calculating. The LTV formula to calculate the Loan-To-Value Ratio is quite simple to understand and calculate. Loan-To-Value Ratio is calculated by dividing the total. Combined loan-to-value (CLTV) ratio is the ratio of all loans on a property to the property's value. Lenders use it to determine risk of default. LTV in real estate is a financial term used by lenders to express the ratio of a loan to value of an asset purchased. Learn more, here.

Calculate Mortgage Percentage

Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Like an interest rate, the APR is expressed as a percentage. Here's how to use the formula: Convert the annual interest rate to a monthly interest rate: Divide the annual interest rate by For example, if your annual. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Equation for Mortgage Payments ; r: Rate, The mortgage interest rate is paid annually, so divide the rate by 12 to get the monthly rate. For example, a 6% rate. How to use this mortgage calculator · To find the monthly mortgage payment on a home, given current mortgage rates and a specific home purchase price · To find. Use this calculator to generate an amortization schedule for your current mortgage. Quickly see how much interest you will pay, and your principal balances. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more. Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Like an interest rate, the APR is expressed as a percentage. Here's how to use the formula: Convert the annual interest rate to a monthly interest rate: Divide the annual interest rate by For example, if your annual. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Equation for Mortgage Payments ; r: Rate, The mortgage interest rate is paid annually, so divide the rate by 12 to get the monthly rate. For example, a 6% rate. How to use this mortgage calculator · To find the monthly mortgage payment on a home, given current mortgage rates and a specific home purchase price · To find. Use this calculator to generate an amortization schedule for your current mortgage. Quickly see how much interest you will pay, and your principal balances. Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. For most loans, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both. Use SmartAsset's free mortgage calculator to estimate your monthly mortgage payments, including PMI, homeowners insurance, taxes, interest and more.

Your mortgage term can significantly impact your monthly payments, so select a term that suits your financial situation. . Mortgage rate: This refers to the. Mortgage principal amount: This is the purchase price minus your down payment. Term and Interest rate: Choose a term and interest rate that best suits your. Your monthly payment may include additional costs, including HOA fees, condo fees and utilities, which are not included. Loan terms and mortgage interest rates. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts. Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home. For example, suppose you have a year fixed rate mortgage for $, at percent. Your monthly mortgage payments would be $, not including. Our mortgage calculator can help you determine what your monthly mortgage percentage of the amount of the loan. 4 %. 4 %. Mortgage Loan Type? Choose the. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Use our free mortgage calculator to find out how much you'll be paying monthly on your home mortgage, including taxes, insurance, PMI and closing costs. How to Calculate Monthly Mortgage Payments Lenders usually list interest rates as an annual amount. To determine the monthly rate, divide the annual amount by. This calculator helps you to determine what your adjustable mortgage payments may be. loginjoker123.ru provides FREE mortgage annual percentage rate calculators and loan calculator tools to help consumers learn more about their mortgage APR. Calculate your regular mortgage payments, based on the amount, rate, payment frequency and mortgage term. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan. The annual interest rate on your mortgage. %. Mortgage Payment: Interest over term. With fixed-rate mortgages, your interest rate and monthly payment stay the same for the entire term. With variable-rate mortgages, interest rates change with. We used our current mortgage rates for this estimate, but keep in mind, available loan products vary by county, which could affect your estimated rate and. Calculate your mortgage · Home Purchase Price · Down Payment % · Interest Rate. Mortgage Calculator ; Home Value: $ ; Down payment: $ % ; Loan Amount: $ ; Interest Rate: % ; Loan Term: years. The amount you expect to borrow from your financial institution. · Annual interest rate for this mortgage. · The number of years and months over which you will.

Shoes That Help Correct Bunions

Scholl's Nova Slip-on Sneaker is our pick. Despite the lower price, they had some of the highest marks in testing. The width in the toe area offered us bunion. Material that moves with you – choose shoes made of fabrics that stretch and offer a little “give.” Mesh and canvas are good choices. A natural shape that. Scholl's, Hoka, New Balance, Clarks, Sole Bliss, Birkenstock, and FitVille offer shoes specifically designed for individuals with bunions. By investing in. At Sargasso & Grey, we have designed a range of shoes to offer customers with bunions and bunionettes a more comfortable footwear experience. Greenwald can recommend custom orthotics to give your feet advanced support and relieve bunion symptoms. With the right footwear, you can avoid worsening bunion. The support and stability the design offers can reduce symptoms of painful bunions and provide natural relief. Other conservative treatments, such as applying. Arch support: Good arch support can properly align your feet to help distribute weight evenly across the foot and reduce pressure on bunions. Footlogics is the name to remember for high-quality shoe inserts for bunions. Our products are carefully designed and manufactured to provide the very best in. Calla footwear has been designed for bunion sufferers, with plenty of extra cushioning, arch support, and room in the footbed, using soft leather for comfort. Scholl's Nova Slip-on Sneaker is our pick. Despite the lower price, they had some of the highest marks in testing. The width in the toe area offered us bunion. Material that moves with you – choose shoes made of fabrics that stretch and offer a little “give.” Mesh and canvas are good choices. A natural shape that. Scholl's, Hoka, New Balance, Clarks, Sole Bliss, Birkenstock, and FitVille offer shoes specifically designed for individuals with bunions. By investing in. At Sargasso & Grey, we have designed a range of shoes to offer customers with bunions and bunionettes a more comfortable footwear experience. Greenwald can recommend custom orthotics to give your feet advanced support and relieve bunion symptoms. With the right footwear, you can avoid worsening bunion. The support and stability the design offers can reduce symptoms of painful bunions and provide natural relief. Other conservative treatments, such as applying. Arch support: Good arch support can properly align your feet to help distribute weight evenly across the foot and reduce pressure on bunions. Footlogics is the name to remember for high-quality shoe inserts for bunions. Our products are carefully designed and manufactured to provide the very best in. Calla footwear has been designed for bunion sufferers, with plenty of extra cushioning, arch support, and room in the footbed, using soft leather for comfort.

At Sole Bliss, we specialise in comfortable sneakers for bunions with a collection of over 50 styles to choose from. Do wide-fitting shoes help bunions? Yes. Yes, wide and supportive running shoes for men can help manage bunion pain. They offer more room for the bunion, reducing friction on the affected area. The. Avoid shoes with little cushioning or “give” since these can irritate your bunion. Natural, breathable materials are the best overall for foot health, but soft. Thus, optimal footwear for those with bunions (or bunionettes, for that matter) should leave open the possibility for correcting the bunion with a toe separator. Look for shoes that have: 1) Stretchable, breathable qualities (like a good slip-on shoe), 2) good arch support and 3) a wide toe box. Our shoes are designed with roomy toe-boxes, soft interiors, arch support and motion control to help with your bunions. bunion correct boots For boots, you could try the Dr. Scholl's brand which should help to keep your feet in the right position. The ankle boots (below) cover. Collection: Shoes for Bunions ; Propet One - Women's Athletic Sneaker · reviews · $ ; Vionic Walker - Women's Shoe · 62 reviews · $ ; Softwalk Sonoma -. Greenwald can recommend custom orthotics to give your feet advanced support and relieve bunion symptoms. With the right footwear, you can avoid worsening bunion. Bunion-friendly shoes should have seamless elastic mesh in the toe area to help prevent rubbing and pressure on the bunion. Prioritizing support and. Wide-toe Box Shoes – The ideal shoes for bunions are the ones that feature a wide-toe box, having more space in the toe area helps alleviate pressure and. Scholl's Nova Slip-on Sneaker is our pick. Despite the lower price, they had some of the highest marks in testing. The width in the toe area offered us bunion. They're specifically designed to relieve foot and ankle pain, including bunion pain. A custom orthotic is a highly recommended shoe modification to help relieve. Drew's soft, nearly seamless linings also help to protect bunions and relieve pain. Image. Shoes For Bunions. Pick the knit loafers with good arch support, cushioned insoles, and wide toe to absolutely enjoy wearing the shoe for a longer time. Bunions can be annoying. To sum up, people with bunions should wear comfortable bunion shoes. Opt for footwear with a wide toe box a wide toe shoes. Custom orthotics are specially made for your feet to give you greater support, balance and bunion relief. Use footwear accessories to help soothe and protect. Fulton insoles are a great way to add arch support to any shoe, to help make prevent bunions from growing, and alleviate pressure from the front of your foot. We start with KURUSOLE—our patented heel-cupping technology that hugs your heels and fully supports your feet. At the midsole, our shoes have KURUCLOUD to help. The Best 15 Bunion Shoes In ; Brooks Ghost 15 · /10 · /10 ; HOKA Bondi 8 · /10 · /10 ; Altra Via Olympus 2 · /10 · /10 ; Brooks Glycerin 21 · /

Target W2 Online Former Employee

Log in to access and manage your employment and income information stored in The Work Number® database. Get started by signing up. PRIDE Industries provides competitive business services to fuel our mission of creating employment for people with disabilities. You need to go to Tax Form Management and Login with Employer Code Then you register and voila!!! - you will be able to download W2(if. View up to seven years of your issued tax forms. Just log in to your account and choose Tax Forms in the "Statements" tab. IRS Tax. If your facility does not use Atlas Connect, you can log in here on loginjoker123.ru Former Employee or Beneficiary? Other Tax Forms (W2, W4): HCAhrAnswers . If you are an employee of a company that uses ADP for payroll and tax filing Save this document for future reference. click-target-circles. Corporate responsibility. Have a question about corporate responsibility at Target? Email us at [email protected]; If you are inquiring about a. Former Federal Employee or Prior Service, Verification of Annuity. Subtopic. Select a subtopic Related Topics. First name (Person associated with the CSA/F. The employer files Form C after filing the related employment tax return for the period for which the credit is claimed. The IRS recommends that qualified. Log in to access and manage your employment and income information stored in The Work Number® database. Get started by signing up. PRIDE Industries provides competitive business services to fuel our mission of creating employment for people with disabilities. You need to go to Tax Form Management and Login with Employer Code Then you register and voila!!! - you will be able to download W2(if. View up to seven years of your issued tax forms. Just log in to your account and choose Tax Forms in the "Statements" tab. IRS Tax. If your facility does not use Atlas Connect, you can log in here on loginjoker123.ru Former Employee or Beneficiary? Other Tax Forms (W2, W4): HCAhrAnswers . If you are an employee of a company that uses ADP for payroll and tax filing Save this document for future reference. click-target-circles. Corporate responsibility. Have a question about corporate responsibility at Target? Email us at [email protected]; If you are inquiring about a. Former Federal Employee or Prior Service, Verification of Annuity. Subtopic. Select a subtopic Related Topics. First name (Person associated with the CSA/F. The employer files Form C after filing the related employment tax return for the period for which the credit is claimed. The IRS recommends that qualified.

You can, however, choose to forgo the sending of a paper copy, and choose to only access your W-2 online. To take advantage of the paperless-only option. Reduce Time to Target · Increase Production · Reduce Human Variability form of cookies. This information might be about you, your preferences or your. We target low-wage industries, for example, because of high rates of violations or egregious violations, the employment of vulnerable workers, or rapid changes. Employers can provide the phone number and opt-out form to their employees Target Retirement Fund determined by your age. The day period begins on. Check out Target's employee benefits — competitive pay, store discount, insurance coverage and education assistance are a few of the many perks. Yes, SRS Acquiom will deliver a Form W-2 to each employee/payee for any payments made during the tax year. What. Employees can request W2s, ask about company benefits, and more Are you a current or former MarketSource employee looking for a W2 or with a. Here is a list of helpful links for Superior Ambulance employees! Alumni Questionnaire Certification Courses (Enrollware) Continuing Education (Vector. The Workday app provides secure, mobile access to your Workday applications on-the-go. As an employee, our simple interface allows you to • Review your pay. former or present official capacity of the person against judgments employee benefit plan, settlements, and reasonable expenses, including. Contact the IRS: If Target is unable to help, you can request a copy of your W-2 from the IRS by filing Form , Substitute for W-2 Wage and Tax Statement. employee discount, short term disability, long term disability, paid sick leave, paid national holidays, and paid vacation. Find. Former Target employees can access their W2 forms the Workday portal using the same login credentials from My Time Target. The W2 form is available for download. What is it? WinTeam has always included a target post pay rate feature to help you with budgeting when scheduling employees. We made enhancements to it and now. Form I-9 for establishing identity and employment authorization to work in the U.S. Employer's Business or Organization Address: Target Parkway N. City. The Work Number database provides comprehensive verification services for commercial and government verifiers, employers and employees. forms properly, use your right mouse key instead of the left when selecting the document and a menu will pop-up. From that menu select "Save Target As. To log in your Target Corporation k account, go to Alight Solutions website and enter you username and password. Call the payroll department of your current or former employer. This is the easiest way to get an old W-2 form. Employers are required to save important tax.

Top Recruiting Websites For Employers

The US News job search site has easy-to-use filters to help you find the right jobs by location, salary and date posted. Job search platforms like LinkedIn, Glassdoors, and Indeed are popular channels for guiding you toward the most fulfilling career opportunities. The Best Job Posting Sites for Employers · Upwork · Indeed · LinkedIn · Handshake · loginjoker123.ru · Jora · Ladders · Google Jobs; AngelList; PostJobFree; Hubstaff. Number five on our list is loginjoker123.ru, a top Jobs and Employment website. Visitors see pages per visit and spend minutes on the website. The. We'll dive into some of the best job search websites and cover different search tools, both online and off, that will help you during your job search. Indeed aggregates job listings from thousands of job boards, career sites and recruiter listings. Indeed helps employers find the right candidates out of a. We researched and reviewed the 10 best job search websites to help you land your dream gig. Sites were ranked based on ease-of-use, cost, size, reputation. Indeed is a search engine that aggregates job posts from thousands of listings on job boards, agency sites, and company career sites. It's also probably the. This guide will cover a number of the best free job posting sites (including remote job boards) in detail and cover their strengths and weaknesses. The US News job search site has easy-to-use filters to help you find the right jobs by location, salary and date posted. Job search platforms like LinkedIn, Glassdoors, and Indeed are popular channels for guiding you toward the most fulfilling career opportunities. The Best Job Posting Sites for Employers · Upwork · Indeed · LinkedIn · Handshake · loginjoker123.ru · Jora · Ladders · Google Jobs; AngelList; PostJobFree; Hubstaff. Number five on our list is loginjoker123.ru, a top Jobs and Employment website. Visitors see pages per visit and spend minutes on the website. The. We'll dive into some of the best job search websites and cover different search tools, both online and off, that will help you during your job search. Indeed aggregates job listings from thousands of job boards, career sites and recruiter listings. Indeed helps employers find the right candidates out of a. We researched and reviewed the 10 best job search websites to help you land your dream gig. Sites were ranked based on ease-of-use, cost, size, reputation. Indeed is a search engine that aggregates job posts from thousands of listings on job boards, agency sites, and company career sites. It's also probably the. This guide will cover a number of the best free job posting sites (including remote job boards) in detail and cover their strengths and weaknesses.

Here is a list of job boards you can use when sourcing for your roles in USA. Sign up for free to get instant access to top talent in USA. Discover the best job search sites for finding your dream job or connecting with the top talent effortlessly. Compare alternatives, pricing, and reviews! Handshake is where employers of all sizes can hire from the largest network of responsive, active, and diverse talent in the US—seamlessly, quickly. Post jobs for free. #1 rated hiring site in the U.S. 4 out of 5 employers ZipRecruiter finds us the best people for the job.” Employer Reviews. M. 10 Best International Job Boards for Fast Hiring in · 1. LinkedIn · 2. Indeed · 3. Glassdoor · 4. ZipRecruiter · 5. Monster · 6. CareerBuilder · 7. Indeed is one of the best free job posting sites for employers, and its paid plans give you several tools to recruit talented candidates. Navigating the Modern Job Market: Top 12 Online Job Boards and Job Search Engines · 1. Indeed · 2. LinkedIn · 3. Glassdoor · 4. ZipRecruiter · 5. Monster · 6. We list the 47 best job search websites when looking for jobs online. This is also an excellent resource for employers who may only be used to using the bigger. As part of that, many are postings openings on websites that prioritize recruiting It also features an annual list of the top 50 employers for HBCU graduates. Snagajob is the leading online job board with a focus on hourly jobs. It has over million registered job seekers and job opportunities at employer. Check out our comparison of the 16 best job posting sites for recruiters below. Our goal: to help you find the platform that will allow you to reach the right. ZipRecruiter reaches 12M+ job seekers a week * on a mix of channels and instantly sends jobs to + leading, relevant job sites to save employers time and. We've curated a list of the top 15 reliable job search platforms. Each of the following sites has some unique advantages to support your job search. Discover the best job search sites for finding your dream job or connecting with the top talent effortlessly. Compare alternatives, pricing, and reviews! Indeed aggregates job listings from thousands of job boards, career sites and recruiter listings. Indeed helps employers find the right candidates out of a. Kemecon provides a comprehensive job listing service and attracts top people from across the world. Upwork and Freelance are great for locating freelancers. Follow this guide to expand your job search, get a list of the best job search sites, and uncover a wealth of new job leads (and tools to get you noticed when. Indeed is one of the top job boards but recent changes have left recruiters wanting more. Here are the top job board alternatives. Indeed: Indeed is a comprehensive job search engine that aggregates listings from various sources, including company websites and job boards. It. Best job posting sites for recruiters · 1. Indeed · 2. LinkedIn · 3. Career Builder · 4. Jobserve.

Blower Motor Module Cost

We carry a large selection of HVAC blower motor modules in many types and at variable speeds. Our motor control modules are high-functioning, cost-effective. ACDelco GM Original Equipment HVAC Blower Motor Resistors provide stepped voltage drops to provide multiple blower fan speeds and are GM-recommended. We carry a large selection of HVAC blower motor modules in many types and at variable speeds. Our motor control modules are high-functioning, cost-effective. ICP - ICP, , 3/4 HP to V ac Replacement ECM Blower Motor Module for FXM4XA1 Fan Coil. Online price. In-store price & availability may. Get the job done with the right part, at the right price. Find our best fitting blower motor resistors for your vehicle and enjoy free. You can reasonably expect to find replacement blower motors at Parts Geek from $20 to $, while the majority of these motors cost between $ - $ when you. A furnace blower motor replacement costs around $ to $ for parts and labor. The part costs an average of $ to $, and labor costs about $ to $ The average price of replacing a blower motor is $, with a usual range of $ to $ With a warranty, labor costs may be as low as $ Modules ; York Protector Module. York. MSRP: $ Now: $ ; Carrier CESO Chiller Control Module (CCM). Carrier. We carry a large selection of HVAC blower motor modules in many types and at variable speeds. Our motor control modules are high-functioning, cost-effective. ACDelco GM Original Equipment HVAC Blower Motor Resistors provide stepped voltage drops to provide multiple blower fan speeds and are GM-recommended. We carry a large selection of HVAC blower motor modules in many types and at variable speeds. Our motor control modules are high-functioning, cost-effective. ICP - ICP, , 3/4 HP to V ac Replacement ECM Blower Motor Module for FXM4XA1 Fan Coil. Online price. In-store price & availability may. Get the job done with the right part, at the right price. Find our best fitting blower motor resistors for your vehicle and enjoy free. You can reasonably expect to find replacement blower motors at Parts Geek from $20 to $, while the majority of these motors cost between $ - $ when you. A furnace blower motor replacement costs around $ to $ for parts and labor. The part costs an average of $ to $, and labor costs about $ to $ The average price of replacing a blower motor is $, with a usual range of $ to $ With a warranty, labor costs may be as low as $ Modules ; York Protector Module. York. MSRP: $ Now: $ ; Carrier CESO Chiller Control Module (CCM). Carrier.

If the blower motor is not covered by the manufacturer's warranty, it costs $ plus labor. A big or variable-speed HVAC blower motor might cost anywhere. Blower Motor Module (2) Condenser Motor (29) Double Shaft Blower Motor (1) Price (Low to High), Price (High to Low), Newest Items. Sort By Featured. Get free shipping on qualified HVAC Blower Motor products or Buy Online Pick Up in Store today in the Automotive Department. Hello again, loginjoker123.ru If you can rate my input so far, I can avoid spending days on this without any pay at all. Standard blower motors operate at a single speed and cost around $ to replace, including parts and labor. Variable-speed motors cost $ and. Armstrong Air 56W67 3/4 HP Blower Motor RPM V - Alternate / Replacement Part Numbers: R Product Description: 56W67 3/4 HP Blower Motor Hvac blower motor control module. A4, s4. A5, s5. A8, s8. Q5. Rear. Audi Dealer Price. $ Fulfillment Options. Shipping. Estimating Cost. - +. Add. Motor type. Standard blower motors operate at a single speed and cost around $ to replace, including parts and labor. Variable-speed motors. The variable speed EC Motor has the best efficiency and control, removes up Preset airflow rate to maintain a given rate of airflow as needed. The variable speed EC Motor has the best efficiency and control, removes up Preset airflow rate to maintain a given rate of airflow as needed. A blower motor replacement costs $ on average, with a typical range of $ to $ With a warranty, you might pay as little as $ for labor alone. The average cost for a Blower Motor Replacement is between $ and $ · Labor costs are estimated between $68 and $86 while parts are priced between $ and. Blower Motor · Blower Motor Connector · Blower Motor Clips · Blower Motor Control Module Connectors · Motor Housing · Motor Regulator · Motor Shaft Adapter. price mark up and labor costs since once website I looked at said the motor or module for this model. There's a first time for everything though. Blower Motor Module (3) 3 Products Blower Motor Module; Inducer Motor (2) 2 fee or the cost of return shipping. In the case of unattended. It's time to get your blower fan and enjoy the fresh air during the hot periods. Find affordable blower motor control module from international wholesalers. motor, then module will go out and they have to come back to replace module at additional cost. Is that true? img. logo. HVAC Technician: Tamar D. If the motor. Chevrolet Traverse Hvac Blower Motor Control Module(70) ; 75 · current price $ ; 46 · current price $ ; 99 · current price $ ; 38 · current price $ The average cost for a Blower Motor Switch Replacement is between $ and $ Labor costs are estimated between $62 and $78 while parts are typically priced. Item Number. ; Placement on Vehicle. Engine Compartment ; Brand. Holstein ; Accurate description. ; Reasonable shipping cost.

Free Accounting Certification Courses

With the AccountingCoach large number of free online courses, you can start learning today and get an accounting certificate! Get an overview of Northwestern's online fundamentals of accounting post-bacc certificate program, including required courses. The 10 Best Free Accounting Courses Online with Certificate · 1. Certificate in Accounting and Finance · 2. Accounting Ethics · 3. Setting Up Accounting. My MOOC is an online training platform. MOOC stands for Massive Open Online Courses, which means that they are online courses accessible to all. The U.S. Small Business Administration offers a free accounting course online that introduces students to accounting principles. Students should expect to study. Overview · Accounting Fundamentals Course Overview · Accounting Fundamentals Learning Objectives · Who Should Take This Free Accounting Course? · Accounting. Our exclusive collection of free accounting courses includes entry-level accounting courses for beginners and more advanced programmes for ambitious learners. Our Finance and Accounting online training courses from LinkedIn Learning (formerly loginjoker123.ru) provide you with the skills you need, from the fundamentals. Learn Accounting with these free courses designed for beginners and taught by financial experts. Enroll now for free and receive a free certificate upon. With the AccountingCoach large number of free online courses, you can start learning today and get an accounting certificate! Get an overview of Northwestern's online fundamentals of accounting post-bacc certificate program, including required courses. The 10 Best Free Accounting Courses Online with Certificate · 1. Certificate in Accounting and Finance · 2. Accounting Ethics · 3. Setting Up Accounting. My MOOC is an online training platform. MOOC stands for Massive Open Online Courses, which means that they are online courses accessible to all. The U.S. Small Business Administration offers a free accounting course online that introduces students to accounting principles. Students should expect to study. Overview · Accounting Fundamentals Course Overview · Accounting Fundamentals Learning Objectives · Who Should Take This Free Accounting Course? · Accounting. Our exclusive collection of free accounting courses includes entry-level accounting courses for beginners and more advanced programmes for ambitious learners. Our Finance and Accounting online training courses from LinkedIn Learning (formerly loginjoker123.ru) provide you with the skills you need, from the fundamentals. Learn Accounting with these free courses designed for beginners and taught by financial experts. Enroll now for free and receive a free certificate upon.

We're offering this endorsed accounting certificate online free of charge. Our free accounting certifications are based on the same high-quality materials as. This free online Accounting course is designed to enrich your knowledge about systems for gathering, evaluating, and reporting information about financial and. Online accounting classes designed for any stage of your career. SNHU offers 2 online accounting certificates, each geared toward different points in your. Hundreds of FREE courses available across all Sage products to help you unlock your software's full potential. From getting started for beginners to advanced. Learn Accounting, earn certificates with paid and free online courses from MIT, University of Pennsylvania, University of Michigan, UC Irvine and other top. Financial Accounting is an online accounting course offered by Harvard Business School Online. Learn more and register for an upcoming class. course. Here's a link to explore: ~loginjoker123.ru~. Upvote 1. Downvote Reply. Among the best free online courses, Financial Accounting Made Fun: Eliminating Your Fears, is brought to the edX platform by Babson College. It is a self-paced. The accounting coach website offers free courses in every aspect of accounting. Taught in a clear and step-by-step fashion, the platform will appeal to anyone. Learn to track and analyze finance and how to read financial statements with accounting courses led by top rated instructors on Udemy. This article explores top free online resources and courses to launch or strengthen your bookkeeping education. This free taster course reviews the fundamentals of the 3 key financial statements, including their composition and how to interpret them accurately. Discover how to protect the financial stability of any organization. Learn accounting basics or study more advanced topics in the field with online accounting. University of Illinois Urbana-Champaign. Financial Reporting · University of Pennsylvania. More Introduction to Financial Accounting · Coursera Project Network. This free course, Introduction to bookkeeping and accounting, explains the fundamental rules of double-entry bookkeeping and how they are used to produce the. Do you want to learn everything about bookkeeping? The AccountingCoach offers a great online bookkeeping training for free. Try it today! This online course will demystify financial statements and teach you how managers, Wall Street analysts, and entrepreneurs use an understanding of accounting. Nearly 90, students have enrolled in Coursera's free Accounting Analytics course offered by the University of Pennsylvania's Wharton School of Business. The. Carry knowledge in your pocket. Download the Cursa app. There are hundreds of free courses available, with a free certificate of completion that is saved in.

1 2 3 4 5