loginjoker123.ru

News

How Often Can I Apply For Amex Card

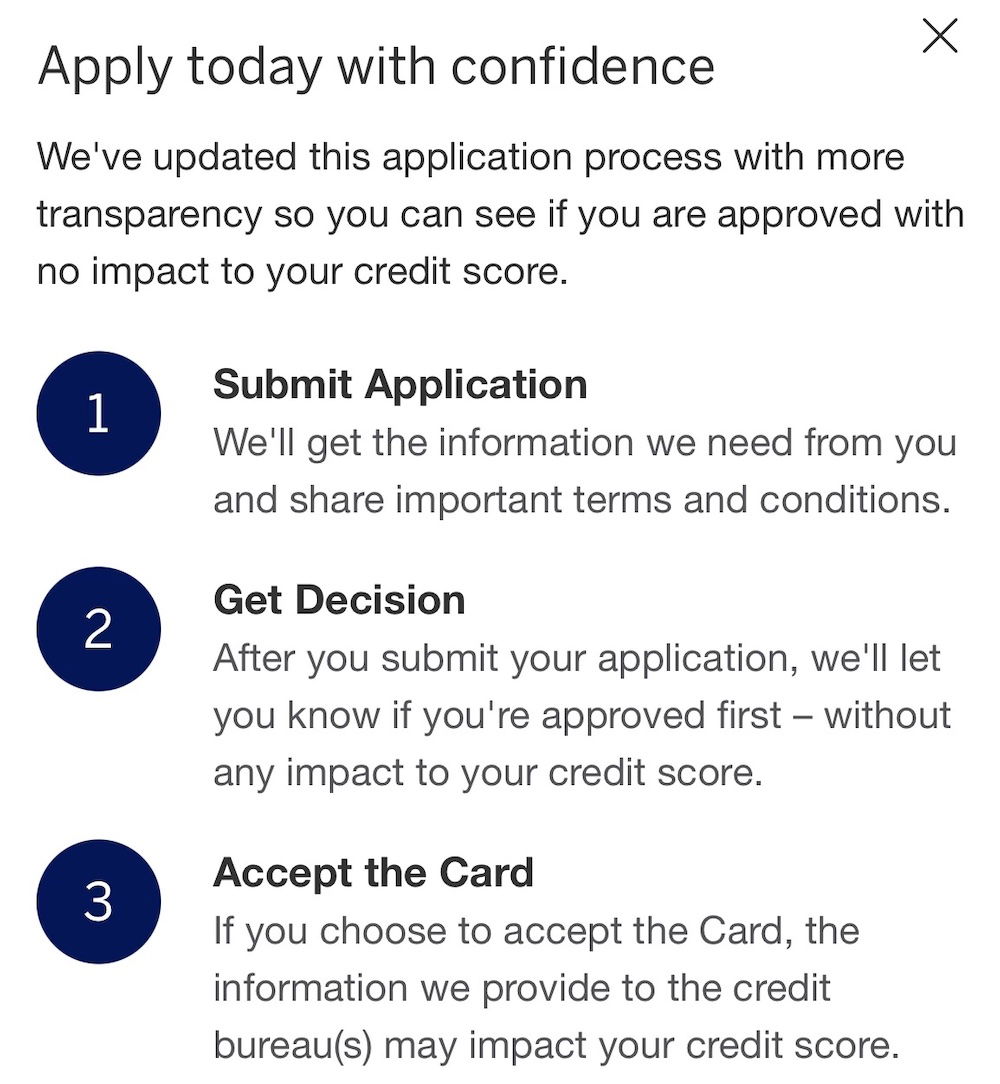

How do I apply for a Credit Card? But Amex often publishes credit card offers that do not include this language. We refer to these offers as Amex “no lifetime language” or “NLL” offers. No. We welcome you to apply for any of our American Express Cards, but please wait at least 30 days from the date you received the decline letter before submitting. If you're approved and accept this Card, your credit score may be impacted. Hilton Honors American Express Surpass Credit Card. Select an eligible flight. When you get to check out, you will see the miles savings applied for your itinerary. Use your Delta SkyMiles® American Express Card. Should I apply to the AMEX card right before I go on active duty or after to You can also apply for the card and then submit your 30+ day orders when you get. You can apply for an American Express Credit Card or Charge Card online in as little as 10 minutes. Here's how. when your card application is approved. As a Cardholder, you're then free to Yes, you can transfer points to a participating frequent flyer partner program or. Not only does American Express limit the number of cards you can have and how often you can apply, but it also tries to ensure that applicants are only eligible. How do I apply for a Credit Card? But Amex often publishes credit card offers that do not include this language. We refer to these offers as Amex “no lifetime language” or “NLL” offers. No. We welcome you to apply for any of our American Express Cards, but please wait at least 30 days from the date you received the decline letter before submitting. If you're approved and accept this Card, your credit score may be impacted. Hilton Honors American Express Surpass Credit Card. Select an eligible flight. When you get to check out, you will see the miles savings applied for your itinerary. Use your Delta SkyMiles® American Express Card. Should I apply to the AMEX card right before I go on active duty or after to You can also apply for the card and then submit your 30+ day orders when you get. You can apply for an American Express Credit Card or Charge Card online in as little as 10 minutes. Here's how. when your card application is approved. As a Cardholder, you're then free to Yes, you can transfer points to a participating frequent flyer partner program or. Not only does American Express limit the number of cards you can have and how often you can apply, but it also tries to ensure that applicants are only eligible.

application fee, when charged to your Delta SkyMiles® Platinum Amex Card. Card Members approved for Global Entry will also receive access to TSA PreCheck at. eligible Schwab account may apply for a Card account. An eligible account When you visit any website, it may store or retrieve information on your. If you have a Card with a Credit Limit, you may also be able to select a qualifying amount of $ or more and a plan duration. When creating a plan for. When manually entering payments, the process is the same for American Express. The App will recognize the 15 digit card number, so there is no need to add. Start Using Your Amex Card with an Instant Credit Card Number for Eligible Cards. Apply, Get Your Instant Card Number, & Start Earning Rewards Today. If you're approved and accept this Card, your credit score may be impacted. Hilton Honors American Express Surpass Credit Card. can only be determined once we've received and processed your application. To review the full range of Cards we have available, please visit americanexpress. Fortunately, American Express has partnered with Nova Credit to enable U.S. newcomers from supported countries to use their foreign credit history when applying. Here's which Amex cards I'm applying for and when to get triple the free cash. However, there are two Amex cards where you can get a extra sign-up bonuses. Make your selection when you apply. View Details & Apply. APPLY WITH Card Members can get access dedicated tickets to some of the most talked. You'll be declined if you apply for a fourth Amex card in 90 days. Since When There is a Change, We Update Everything. So you will never see the. When non-citizens move to the U.S. to study or work, they can apply for credit cards to help build their credit history and earn rewards that they can use for. Other than that, you are, as I understand it, generally allowed to apply for one card every five days, but be approved for no more than two. If you are interested in one of the American Express cards, you can apply on the spot, but there is no obligation to continue if you decide you are not. One of the most significant restrictions when applying for Amex cards is the “once in a lifetime” rule, whereby you can typically only earn the bonus on a card. Amex may automatically increase your card's credit limit if you use it responsibly. If Amex does not offer an automatic increase, you may request one. If you're already a member, you can find out if you prequalify for a credit card before you submit an application. This won't affect your credit score. Frequently asked questions · How do I apply for the Bread Cashback™ American Express® Credit Card? · Does the Bread Cashback™ Card have an annual fee? · Does the. There's an unwritten rule suggesting you can only be approved for one Platinum card every 90 days. While this might be flexible, the system often flags multiple.

Khols Return Policy

In order to complete the return, you must have a proof of purchase. Please review our return, refund, and exchange policies below for purchases made on Sephora. You must return items in-store for a full credit or refund within 90 days of purchase. Bring your Instacart receipt and a government-issued photo ID. buybuy. Kohl's allows returns up to days, with or without a receipt. Of course, if you don't have a receipt, who's to say what happened within. Kohl Wholesale enforces the Federal HACCP regulations for returning product. In the interest of providing product quality, packaging integrity, and to. Items must not be washed. Items must have all original tags attached and intact. Note - "Items must not be worn" policy applies also to underwear and all active. Kohl's has recently changed its “forever policy,” which stated that there are no time limits for returning the products you are unhappy with. The current return. Kohl's does not pay for return shipping costs. A refund will be processed up to 30 days after the items have been received. Returning items delivered by freight. Food network items covered by the warranty can be returned to any Kohl's location at any time. Returns made with the receipt will be credited for the amount. Kohl's will accept any clothing item for return within the standard days window, even if the clothes have been worn. In order to complete the return, you must have a proof of purchase. Please review our return, refund, and exchange policies below for purchases made on Sephora. You must return items in-store for a full credit or refund within 90 days of purchase. Bring your Instacart receipt and a government-issued photo ID. buybuy. Kohl's allows returns up to days, with or without a receipt. Of course, if you don't have a receipt, who's to say what happened within. Kohl Wholesale enforces the Federal HACCP regulations for returning product. In the interest of providing product quality, packaging integrity, and to. Items must not be washed. Items must have all original tags attached and intact. Note - "Items must not be worn" policy applies also to underwear and all active. Kohl's has recently changed its “forever policy,” which stated that there are no time limits for returning the products you are unhappy with. The current return. Kohl's does not pay for return shipping costs. A refund will be processed up to 30 days after the items have been received. Returning items delivered by freight. Food network items covered by the warranty can be returned to any Kohl's location at any time. Returns made with the receipt will be credited for the amount. Kohl's will accept any clothing item for return within the standard days window, even if the clothes have been worn.

About Kohl's Return Policy. Sometimes we purchase things, and it does not turn out the way we expected. If you bought something from Kohl's and are unhappy with. Sephora merchandise purchases through loginjoker123.ru or Sephora at Kohl's locations must be returned in new or gently used condition with a receipt within 60 days. To begin your return, find the order number that appears on the order or shipping confirmation emails. We only accept returns from orders placed on loginjoker123.ru Amazon's standard return policy allows customers to return most items sold and fulfilled by Amazon within 30 days of receipt, for a full refund. Items purchased from Kohls can be returned up to 16 months after the date of purchase. You will need to provide proof of purchase and you should allow at least. If you would like to return or exchange an item purchased on loginjoker123.ru within the United States, please send us a request for a return. For online purchases, returns and exchanges must be initiated within 30 days from the delivery date, while in-store purchases must be returned or exchanged. Kohls return policy is pretty straightforward. Returns are accepted within 30 days of purchase, and merchandise must be in original, unused. In most cases, returns are accepted up to days after the original purchase date. This generous window gives you plenty of time to decide if an item is. 1. Kohl's: Kohl's describes its return policy as "no questions asked" and "hassle free." No receipt? No problem. There are also no time restrictions on when. Most items, whether purchased online at loginjoker123.ru or in the store, are eligible for an even exchange within 90 days of the purchase for non-Kohl's Card. Consumers can return their items to participating Kohl's locations. Signs in store point to a dedicated service desk, where they can hand their items to a store. About Kohl's Return Policy. Sometimes we purchase things, and it does not turn out the way we expected. If you bought something from Kohl's and are unhappy with. I'm not sure how new this is, but it appears that Kohls has changed their return policy. Items now must be returned within days of purchase. Food network items covered by the warranty can be returned to any Kohl's location at any time. Returns made with the receipt will be credited for the amount. Eligible returns received within 90 days of receipt of shipment will be issued to the original form of payment when available. Even though I had a receipt, they would only give me $ back! When I asked why she said it was during their $10 kohls cash promotion. I told her this was my. You have days to return a product you purchased. This applies to the products without tags as well. Premium electronics purchases are the exception. Sephora merchandise purchases through loginjoker123.ru or Sephora at Kohl's locations must be returned in new or gently used condition with a receipt within 60 days. Kohl's return policy is not the same as Land's End. If you purchased your Land's End merchandise at a Kohl's store or loginjoker123.ru, more than likely, the answer is.

Switching From Traditional Ira To Roth Ira

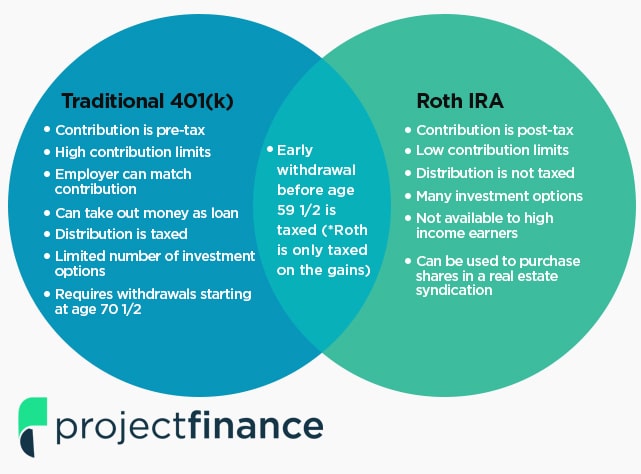

A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. The conversion is reported on Form PDF PDF, Nondeductible. How do you transfer funds to a Roth IRA? You can convert the funds by having your plan administrator facilitate the funds transfer, or by allowing the. By converting to a Roth IRA, you'll have assets that won't be taxed when withdrawn, potentially allowing you to better manage your tax brackets and enable more. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. Converting a Roth IRA can help to diversify your portfolio · When you convert to a Roth IRA, you don't have to worry about future tax rates · When you convert to. What's your retirement date? Typically, you wouldn't convert a traditional IRA to a Roth IRA if your plan is to retire soon and start making withdrawals. All tax-deferred IRAs, including traditional, rollover, SIMPLE,2. SEP, and SAR-SEP IRAs, are eligible for a Roth IRA conversion. Tax legislation enacted in. There are no conversion limits when converting from a traditional retirement account to a Roth IRA or from one type of IRA to a Roth IRA. You can contribute any. Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth. A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. The conversion is reported on Form PDF PDF, Nondeductible. How do you transfer funds to a Roth IRA? You can convert the funds by having your plan administrator facilitate the funds transfer, or by allowing the. By converting to a Roth IRA, you'll have assets that won't be taxed when withdrawn, potentially allowing you to better manage your tax brackets and enable more. The original conversion from a Traditional IRA to a Roth IRA must be completed within 60 days after the end of the tax year. A distribution from an IRA is. Converting a Roth IRA can help to diversify your portfolio · When you convert to a Roth IRA, you don't have to worry about future tax rates · When you convert to. What's your retirement date? Typically, you wouldn't convert a traditional IRA to a Roth IRA if your plan is to retire soon and start making withdrawals. All tax-deferred IRAs, including traditional, rollover, SIMPLE,2. SEP, and SAR-SEP IRAs, are eligible for a Roth IRA conversion. Tax legislation enacted in. There are no conversion limits when converting from a traditional retirement account to a Roth IRA or from one type of IRA to a Roth IRA. You can contribute any. Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. converting it to a Roth.

“If your IRA value went from $1 million to $,, for instance, a Roth conversion may be a good idea. You could pay taxes on $, and roll it into a Roth. A Roth conversion occurs when you move funds from a traditional individual retirement account (IRA) to a Roth IRA. Paying Taxes on the Roth IRA Conversion. If you have a traditional IRA but like the idea of tax-free growth and withdrawals, then why would you ever hesitate? When a traditional IRA is converted to a Roth IRA the taxpayer has to pay tax on the deductible contributions and any earnings in the account at the time of. Selling investments: Most traditional IRA investments can convert to a Roth IRA without being sold. Most (k)s convert in cash. The amount converted is treated as a distribution from the Traditional IRA, and all or a part of the amount may be included in gross income and subjected to. Converting your Traditional IRA to a Roth IRA may be beneficial to you in the long term. There are many factors to consider including the amount to convert. All tax-deferred IRAs, including traditional, rollover, SIMPLE,2. SEP, and SAR-SEP IRAs, are eligible for a Roth IRA conversion. Tax legislation enacted in. by TurboTax• Updated 8 months ago. It's the process of transferring money from a traditional IRA to a Roth IRA by one of the following methods: The amount. Under current law, all individuals have the option to convert all or part of their Traditional IRA assets to a Roth IRA. Convert investments from your traditional IRA brokerage account If you hold ETFs (exchange-traded funds), individual stocks and bonds, or other investments in. Generally, you'll only be able to transfer a (k) to a Roth IRA if you are rolling over your (k), the plan allows in-service withdrawals, or the plan. If you hold both pre-tax and after-tax (non-deductible) money in your Traditional or Rollover, IRA, the conversion to a Roth IRA is a taxable. Convert a traditional IRA to a Roth IRA · Open the. R. screen in the · Enter 1 of the following items for a Roth conversion: Enter. 2 · Enter. X. in the. Convert your existing T. Rowe Price IRA (Traditional IRA, Rollover IRA, Spousal IRA) to a Roth IRA. Get Started. You can convert a traditional IRA to a Roth no matter your age. But if the conversion boosts your income, it could have taxing consequences. What Are IRA to Roth Conversions? A Roth conversion involves moving assets from a qualifying retirement plan into a Roth IRA. There are a couple of ways to do. Traditional IRA to Roth IRA conversions are taxable. When converting your traditional IRA to a Roth IRA, you must pay taxes on any traditional IRA. While the decision is ultimately up to you, transferring assets from a Traditional IRA to a Roth IRA is known as a Roth conversion and can. As long as taxes are paid on the conversion (i.e., pre-tax) amount, anyone can convert a traditional IRA, or other eligible retirement plan asset,Footnote 1 to.

Ebt Pick Up

Customers may expect to receive their EBT card within five to seven days and are not required to visit the EBT Office to receive their card. Curbside pick-up using EBT o Walmart allows this. ▫ Call and ask ahead of time to make sure. o Call and check if retailers can swipe EBT cards at curbside. Online grocery shopping and delivery at loginjoker123.ru Buy EBT eligible items on dairy, bread, meat, vegetables, candy, cereal, and frozen food. Save money. SNAP is distributed to a Colorado EBT card, also known as the Colorado Quest card. Cash benefits are distributed either to the EBT card, a personal bank account. Get the ConnectEBT Mobile App. It's the easy and free way to manage your EBT Card. Check your available balance anytime, anywhere; Review up to 12 months of. Step 3: Get your benefits! If approved, your monthly SNAP benefits will be available on an Oregon Trail Card that you can pick up or get mailed to you. Learn. Online SNAP EBT payments for pickup and delivery orders are available in all our locations. Most of our stores accept SNAP EBT payments for in-store purchases. After shopping for grocery items, go to your cart and select “Checkout.” Then look for the SNAP checkbox on the order summary screen. Albertsons now accepts SNAP EBT payments in store and for grocery pickup. Check back with us about online SNAP and EBT grocery delivery at a later date. Customers may expect to receive their EBT card within five to seven days and are not required to visit the EBT Office to receive their card. Curbside pick-up using EBT o Walmart allows this. ▫ Call and ask ahead of time to make sure. o Call and check if retailers can swipe EBT cards at curbside. Online grocery shopping and delivery at loginjoker123.ru Buy EBT eligible items on dairy, bread, meat, vegetables, candy, cereal, and frozen food. Save money. SNAP is distributed to a Colorado EBT card, also known as the Colorado Quest card. Cash benefits are distributed either to the EBT card, a personal bank account. Get the ConnectEBT Mobile App. It's the easy and free way to manage your EBT Card. Check your available balance anytime, anywhere; Review up to 12 months of. Step 3: Get your benefits! If approved, your monthly SNAP benefits will be available on an Oregon Trail Card that you can pick up or get mailed to you. Learn. Online SNAP EBT payments for pickup and delivery orders are available in all our locations. Most of our stores accept SNAP EBT payments for in-store purchases. After shopping for grocery items, go to your cart and select “Checkout.” Then look for the SNAP checkbox on the order summary screen. Albertsons now accepts SNAP EBT payments in store and for grocery pickup. Check back with us about online SNAP and EBT grocery delivery at a later date.

How to Apply · You can apply online on ACCESS HRA. · You can call the DSS OneNumber at to have an application mailed to you. · You can pick up an. Yes, Sprouts customers can pay for online orders with a valid EBT card. Sprouts currently does not accept EBT Cash for online orders. Amazon Grocery Subscription offers: unlimited FREE delivery on orders over $35 from Amazon Fresh or Whole Foods Market, FREE minute pickup from Whole Foods. Some retailers in the District, such as Safeway, also allow SNAP households to reserve food items online for you to pick up and pay using your EBT card in. Free delivery or pickup on all EBT SNAP orders through 12/31/ Now grocery delivery is even more convenient. Use your EBT SNAP card to pay at. SNAP EBT Payment Option is Available in Texas and Louisiana! · Add items to your cart. · Under Order Instructions, put “EBT at Pickup” · At Checkout, you will need. Families using SNAP (Supplemental Nutrition Assistance Program) now have the option to pay for grocery delivery and pickup orders with an EBT (Electronic. How to use EBT online · Step 1. Sign in to your loginjoker123.ru account. From your account, find the payments section & add your EBT card. · Step 2. Build your cart &. You can also set up an appointment at your local department of social services (LDSS) by calling the DHS Call Center at to pick up an EBT vault. KEEP THIS NOTICE SO YOU CAN REFER TO IT. For Cash and SNAP (Supplemental Nutrition Assistance Program, the new name for Food Stamps) benefits, find the. Walmart accepts SNAP benefits via EBT cards at all participating Walmart online pickup & delivery locations. How do I sign up to use my SNAP EBT benefits on. Use your EBT-SNAP card for grocery delivery or pickup. Save More. Now you can save even more with exclusive benefits when you shop with your EBT-SNAP card at. Is there a fee to pick up my groceries? If your order is under $35 there is a $ pickup fee. There is no fee for pickup orders over $ Can I. If you have already provided card numbers and PINs to a third party you should call () to change your PIN or to report your EBT cards as lost or. No, if you have a SNAP EBT card on file in your account, you do not need to meet the order minimum for pickup or delivery as long as you apply SNAP funds to. You can use your EBT card to purchase food items at participating grocery stores, order grocery online for pick up or delivery at participating grocery stores. Currently, any SNAP-Authorized Retailer can allow for customers to complete orders online and pay at the store when they pick up. The Online EBT capability. You can get a temporary replacement EBT card at any HRA Benefits Access Center. The temporary card will have all your available benefits until your permanent. For more information and to find out which stores offer online purchasing for home delivery or pick up visit EBT Online at loginjoker123.ru EBT card online? shows more content. Order Pickup: There are no minimum purchase thresholds for pickup orders. Same Day Delivery: If you're paying with an EBT.

Most Popular Medigap Insurance Company

Medicare supplement Plan G offers the most comprehensive coverage of any of the Medicare supplement insurance plans available to those who are new to Medicare. You can do a ratings search through its website, loginjoker123.ru Q: Why are my choices limited to specific companies and certain plans? A: Private insurance. Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs. In addition to the standard benefits of Medigap plans, an AARP Medicare Supplement Insurance Plan from UnitedHealthcare Insurance Company has many features that. Best Overall: AARP/UnitedHealthcare · Most Medigap Plan Types: Blue Cross Blue Shield · Best Medigap High-Deductible Plan G Provider: Mutual of Omaha · Best for. See how to contact us, and read about how we can, and can't, assist you (PDF). Find more resources at the National Association of Insurance Commissioners. Compare Medicare Supplement (Medigap) plans offered by UnitedHealthcare, understand differences in cost and coverage, and select the plan that is right for. Medicare Supplement Insurance (Medigap). Medicare Supplement insurance is also called Medigap insurance because it covers the "gaps" in Medicare benefits, such. Please contact the company directly for more information. Back to Top. United World Life Insurance Company. Customer Service Phone Number: () ; Medicare supplement Plan G offers the most comprehensive coverage of any of the Medicare supplement insurance plans available to those who are new to Medicare. You can do a ratings search through its website, loginjoker123.ru Q: Why are my choices limited to specific companies and certain plans? A: Private insurance. Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs. In addition to the standard benefits of Medigap plans, an AARP Medicare Supplement Insurance Plan from UnitedHealthcare Insurance Company has many features that. Best Overall: AARP/UnitedHealthcare · Most Medigap Plan Types: Blue Cross Blue Shield · Best Medigap High-Deductible Plan G Provider: Mutual of Omaha · Best for. See how to contact us, and read about how we can, and can't, assist you (PDF). Find more resources at the National Association of Insurance Commissioners. Compare Medicare Supplement (Medigap) plans offered by UnitedHealthcare, understand differences in cost and coverage, and select the plan that is right for. Medicare Supplement Insurance (Medigap). Medicare Supplement insurance is also called Medigap insurance because it covers the "gaps" in Medicare benefits, such. Please contact the company directly for more information. Back to Top. United World Life Insurance Company. Customer Service Phone Number: () ;

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in an original Medicare Plan coverage. Medigap policies help pay. Medigap (Medicare Supplement) is offered by private insurance companies to help fill the “gaps” Medicare doesn't cover, such as copayments, coinsurance and. What is the most popular Medigap plan? According to AHIP (America's Health Insurance Plans) data, there were million people with Medigap in Of. Medicare Supplement Plan G is one of the most popular Medigap plans in Texas. Plan G can also be sold as a high-deductible plan. If you enroll in a high. In this article, we will give you the top ten best Medicare Supplements and tips on choosing the best companies to consider. Plan F has been the most popular because of its generous benefits. It covers the Medicare Part A hospital deductible and co-payments, the Part B deductible, and. Take a look at two of our most popular plans. Horizon Medicare Blue Medicare Supplement plans are provided by Horizon Insurance Company. Medigap Plan F is offered by private companies and provides the most comprehensive coverage of the Medigap plans. It covers % of: Part A coinsurance and. In most states, Medigap plans are named with letters, like plan A, G or L. Medigap plans offer the same benefits, regardless of which insurer you purchase. With Plan F getting more and more expensive (for those who can still buy it), Plan G is now the top choice with Plan N quickly gaining popularity as a promising. AARP/United Health Group; Mutual of Omaha; CVS/Aetna; Anthem; HCSC; Cigna; CNO Financial (Resource Life Insurance Company); BCBS of Massachusetts; Wellmark. In most cases, Medigap insurance companies can sell you only a standardized. Medigap policy. Your best time to buy a Medigap policy is during your Medigap. Priority Health Medicare & Medigap plans. See why we're #1 for individual Medicare Advantage plans in Michigan. Shop plans. Find a Plan; Medicare Advantage. plans from any company that sells them. Companies cannot deny coverage or charge more for current or past health problems. The insurance company may impose. However, the premium you pay for that plan may differ from one company to another. It is important to note that most Medicare supplement plans do not include. Find the Best Medicare Plan for You For more than 90 years, Blue Cross and Blue Shield companies have been putting members first, which is why most doctors. More comprehensive health coverage than the Medigap plan they're buying, can 2 = No health screen means the insurance company will not ask you any. Choose an AARP® Medicare Supplement Insurance Plan from UnitedHealthcare to help cover some of your out-of-pocket medical expenses. Excellus Health Plan, Inc. (d/b/a Univera Healthcare), $, $, $ Globe Life Insurance, $ Excellus Health Plan, Inc. (d/b/a Univera Healthcare), $, $, $ Globe Life Insurance, $

Kdx 200 Graphics

OEM replica style graphics. Produced with Ultra-curve vinyl. Thicker than stock decals. Includes left and right side shroud pieces. Kawasaki KDX SPIKES motocross decals set MX graphics kit. $ Choose your option without plates with plates/blank with plates/with rider. We offer THREE material styles/options for your MX resto. (1) THIN gloss contour-cut decals, that resemble the OEM shape from the factory for a true look. KAWASAKI KDX Graphics Shroud Decal Graphics Kit Headlight Decal KDX made in Usa Quality motorsports material uv laminate finish. KDX KLX decals · KDX tankdecal set · KDX tankdecal set full · KDX sidepanel decals · KDX tankdecal set · KDX tankdecal set · I checked with my dealer for a left side shroud decal for a KDX He said that the decal is not available. Has anyone else had this problem? KDXTank-decals · KDX CC Die-Cut Tank Decals · Die-Cut Tank KDXFull-Rad-shroud-decal-kit · KDX Full Rad shroud decals. BRM Offroad Professional grade custom graphics printed on the highest quality material the industry has to offer for your Kawasaki KDX , KDX & KDX. Graphics Kit Stickers Decals for Kawasaki KDX KDX KDX and Free Custom Number · $$ OEM replica style graphics. Produced with Ultra-curve vinyl. Thicker than stock decals. Includes left and right side shroud pieces. Kawasaki KDX SPIKES motocross decals set MX graphics kit. $ Choose your option without plates with plates/blank with plates/with rider. We offer THREE material styles/options for your MX resto. (1) THIN gloss contour-cut decals, that resemble the OEM shape from the factory for a true look. KAWASAKI KDX Graphics Shroud Decal Graphics Kit Headlight Decal KDX made in Usa Quality motorsports material uv laminate finish. KDX KLX decals · KDX tankdecal set · KDX tankdecal set full · KDX sidepanel decals · KDX tankdecal set · KDX tankdecal set · I checked with my dealer for a left side shroud decal for a KDX He said that the decal is not available. Has anyone else had this problem? KDXTank-decals · KDX CC Die-Cut Tank Decals · Die-Cut Tank KDXFull-Rad-shroud-decal-kit · KDX Full Rad shroud decals. BRM Offroad Professional grade custom graphics printed on the highest quality material the industry has to offer for your Kawasaki KDX , KDX & KDX. Graphics Kit Stickers Decals for Kawasaki KDX KDX KDX and Free Custom Number · $$

Description: KDX C1 model. Restoration Decals - Graphics Logo Kit. Materials mfg. with High Bond adhesives for plastic surfaces and tough laminate. Crafted from durable, weather-resistant materials, these decals are built to withstand the elements and maintain their vibrant appearance over time. Our. KDX decals, available exclusively on AliExpress, offer an exciting way to personalize your KDX , KDX, or KDX model. These high-quality graphics not. Graphic MX provides replacement and custom motorcycle motocross graphics: seat covers, shroud, swingarm, fender, pre printed number plate stickers and. There is a kit of monster graphics for kdx h models at ebay for around $ I think that can be fitted to the e models with a little trimming. Reproduction Decal Kit. Made for the Kawasaki KDX Made from 4mil Ultra Thick vinyl and 2mil laminate. High quality long lasting marine quality decals. Motocross Full Graphics Decal Sticker Kit For Kawasaki KDX KDX · Silk Screen Under Surface Printing,Smooth surface and Very good anti-UV. MADE IN USA! - Reproduction Decal Kit.- Made for the Kawasaki KDX Made from 4mil Ultra Thick vinyl and 2mil laminate.- High quality long lasting. Kawasaki KDX Graphics Kit. Over 70 designs available from AMR Racing and CREATORX Custom Graphics. Largest Selection World Wide. graphics, wraps, decals, and full kits. Check out the Kawasaki KDX models available at Motocal. KDXSR; KDXSR; KDXSR; KDX; KDX; KDX; KDX Graphics Kit for KAWASAKI KDX () Throwback - GREEN Brand New $ to $ Buy It Now Free shipping Free returns. € Graphics Kit - Kawasaki - KDX - - SE - ST Example layout shown. Your order will fit your model. MOTORCYCLEiD is your trusted source for all your Kawasaki KDX Graphics & Decals needs. We expand our inventory daily to give you the. Improve your Kawasaki KDX () with the OEM Series Graphics Kits from KalairGFX. Upgrade your vehicle with premium decorations. Kawasaki KDX Dirtbike Graphics Kit. KAWASAKI KDX KDX KAWASAKI KDX KDX Number Plate. loginjoker123.ru: Team Racing Graphics kit. Buy Kawasaki KDX50 KDX KDX KDX KDX Series graphics skins wraps and decal kits in standard and full coverage design templates with rim graphics. HYENA makes customized graphics and decals for KAWASAKI KDX in crystal. Shop Decal Kits for Kawasaki KDX Quick Dispatch from 24MX - Europe's Largest MX Store. Kawasaki KDX graphics kit made for all KDX motocross models. Graphics available in over designs. Kawasaki KDX Tank Decals Click on the item for more information.

Bridging Money

Ultimately a bridge loan is more money out of your pocket as a homeowner. The bridge loan is a financial resource that may be worthwhile or necessary in the. BRIDGING THE GAP WHEN YOU NEED IT MOST. Bridging Finance Inc. was founded in as a privately held Canadian company providing middle-market Canadian. Manhattan Bridge Capital is a leading hard money lender to professional real estate investors, focusing on three types of loans. Bridge financing definition Bridge financing is a temporary financing solution, used to cover a company's short-term costs until it secures long-term. Bridge financing is a form of temporary financing intended to cover a company's short-term costs until regular long-term financing is secured. Bridging Finance Inc. For the general concept of bridge financing, see bridge loan. Bridging Finance Inc. is a Canadian private lender based in Toronto. Bridge financing (often called a bridge loan) is a short-term financial solution designed to bridge the gap between immediate funding needs and long-term. Bridge financing, also called a bridge loan, is a way to help bridge the gap between closing on your current house and your new place because it allows you to. A bridge loan is a short-term mortgage secured by a portion of the equity in your current home, even if it's for sale, to use toward the down payment on a new. Ultimately a bridge loan is more money out of your pocket as a homeowner. The bridge loan is a financial resource that may be worthwhile or necessary in the. BRIDGING THE GAP WHEN YOU NEED IT MOST. Bridging Finance Inc. was founded in as a privately held Canadian company providing middle-market Canadian. Manhattan Bridge Capital is a leading hard money lender to professional real estate investors, focusing on three types of loans. Bridge financing definition Bridge financing is a temporary financing solution, used to cover a company's short-term costs until it secures long-term. Bridge financing is a form of temporary financing intended to cover a company's short-term costs until regular long-term financing is secured. Bridging Finance Inc. For the general concept of bridge financing, see bridge loan. Bridging Finance Inc. is a Canadian private lender based in Toronto. Bridge financing (often called a bridge loan) is a short-term financial solution designed to bridge the gap between immediate funding needs and long-term. Bridge financing, also called a bridge loan, is a way to help bridge the gap between closing on your current house and your new place because it allows you to. A bridge loan is a short-term mortgage secured by a portion of the equity in your current home, even if it's for sale, to use toward the down payment on a new.

Bridging funding is available on a competitive basis from the Office of the Vice President for Research (OVPR) in instances where an external research grant has. Bridge Project Grants under the Bridge Investment Program are available for bridges with total eligible project costs up to $ million, with minimum grant. As Crystal are a truly independent bridging finance specialist, we work with lenders big and small to find the best deal for your clients. And we do it quickly. Bridging finance is designed to help you buy a house before you've sold your current one. “You can take out bridging finance for a period of up to 12 months,”. Bridging dot com helps you understand the variety of bridging finance, bridging loan companies and short term finance opportunities available in the UK. A bridge loan is a short-term loan used until a person or company secures permanent financing or pays an existing obligation. Less stringent lending criteria: assessed on the exit strategy rather than borrower income or credit history; where a bridging loan is unregulated, it doesn't. A type of commercial loan, business bridging loans are a short-term financial solution for businesses of all sizes. They are also known as “commercial bridging. Bridging loans are split into regulated and unregulated finance. Who lives in the underlying investment will be the determining factor between the two. If you. Once certain stages of development have been completed, it's easier to obtain traditional bank financing. Cash-out Bridge Loan for short term personal or. A bridge loan is a short-term form of financing that is used to meet current obligations before securing permanent financing. It provides immediate cash flow. How does a Together bridging loan work? A Together bridging loan lasts for an agreed term – typically 12 months. We provide the loan you need, and you need to. A bridge loan is a temporary financing option. It is designed to help homeowners “bridge” the gap between the sale of an existing home and the purchase of a new. Bridging loans serve as a short-term financial option, typically utilised for periods ranging from six months up to three years. A hard money bridge loan is a valuable financial tool for borrowers who find themselves in specific situations where traditional lending options aren't. Ultimately a bridge loan is more money out of your pocket as a homeowner. The bridge loan is a financial resource that may be worthwhile or necessary in the. A bridging loan is a short-term loan, where the repayment period can be as little as a few weeks. These loans are meant to 'bridge the gap'. A bridging loan is a short-term secured loan that you'll usually have to pay off within 12 months, though the term can be as short as a week or two. Bridge Loan Rates Today. Short-term bridge loan rates today are typically in the range of %. Mortgage bridge loan rates can vary based on various. BRIDGING LOAN definition: an arrangement by which a bank lends a person some money for a short time until that person can get. Learn more.

How To Learn Css Coding

1. You can go through the CSS course here at sololearn: loginjoker123.ru?ref=app The course is a good way to get started but I would. This course helps you expand your coding foundation and gives you CSS interactive practice to start adding colors and background images or editing layouts. CSS is the language we use to style an HTML document. CSS describes how HTML elements should be displayed. This tutorial will teach you CSS from basic to. Learn CSS: Online CSS courses curated by Coursera · HTML, CSS, and Javascript for Web Developers · Introduction to CSS3 · Programming Foundations with JavaScript. An evergreen CSS course and reference to level up your web styling expertise. Learn HTML CSS is the easiest, most interactive way to learn & practice modern HTML and CSS online. Learn in an interactive environment. Online Tutorials:There are many online tutorials and courses that cater to beginners. Websites like Codecademy, freeCodeCamp, and W3Schools offer interactive. CSS stands for Cascading Style Sheets, it is a simple design language intended to simplify the process of making web pages presentable using CSS properties. CSS. It should be your first stop after learning HTML (not a programming language but a set of rules to organize elements on a web page). CSS is used. 1. You can go through the CSS course here at sololearn: loginjoker123.ru?ref=app The course is a good way to get started but I would. This course helps you expand your coding foundation and gives you CSS interactive practice to start adding colors and background images or editing layouts. CSS is the language we use to style an HTML document. CSS describes how HTML elements should be displayed. This tutorial will teach you CSS from basic to. Learn CSS: Online CSS courses curated by Coursera · HTML, CSS, and Javascript for Web Developers · Introduction to CSS3 · Programming Foundations with JavaScript. An evergreen CSS course and reference to level up your web styling expertise. Learn HTML CSS is the easiest, most interactive way to learn & practice modern HTML and CSS online. Learn in an interactive environment. Online Tutorials:There are many online tutorials and courses that cater to beginners. Websites like Codecademy, freeCodeCamp, and W3Schools offer interactive. CSS stands for Cascading Style Sheets, it is a simple design language intended to simplify the process of making web pages presentable using CSS properties. CSS. It should be your first stop after learning HTML (not a programming language but a set of rules to organize elements on a web page). CSS is used.

Learn HTML CSS is the easiest, most interactive way to learn & practice modern HTML and CSS online. Learn in an interactive environment. CSS Tutorial provides you the complete steps to use CSS styles on building web applications. It helps you to learn the core concepts of CSS. CSS is the language we use to style an HTML document. CSS describes how HTML elements should be displayed. This tutorial will teach you CSS from basic to. I'm looking for a course that does not only teach what each css property does but also a system how to build complex designes and how to structure my html, css. An evergreen CSS course and reference to level up your web styling expertise. Master web development with HTML & CSS courses on Codecademy. From HTML fundamentals to functions and operations, Codecademy courses got your covered! Coding Fantasy is the next-generation platform for learning code by playing games that combines the missing parts of traditional learning. Learn to Code HTML & CSS is an interactive beginner's guide with one express goal: teach you how to develop and style websites with HTML and CSS. Outlining the. This course will give you the tools, training, resources, cheat sheets, and homework so you become comfortable in writing HTML and CSS. Learn CSS with this app for free. Learn offline with 70+ CSS Lessons. This CSS tutorial will teach you the latest standards of CSS/CSS3. HTML & CSS courses · Career path. Front-End Engineer · Skill path. Build a Website with HTML, CSS, and GitHub Pages · Free course. Learn HTML · Free course. Learn. Build your CSS skills on the go with this amazing free app to learn CSS Programming. Become a CSS programming expert by learning the CSS coding language. CSS Tutorial provides you the complete steps to use CSS styles on building web applications. It helps you to learn the core concepts of CSS. 1. Run CSS right in your browser. Open a text editor like Notepad, and write your HTML code, saving the file with loginjoker123.ru This course will teach you HTML and CSS through building and deploying five awesome projects. It is also fully interactive, with over 75 coding challenges. Learn JavaScript. Practice by solving coding challenges in order to improve your logic as well as implementing DOM Manipulation so that you can. HTML & CSS are foundational programming languages used in web development. · No formal prerequisites are necessary for learning HTML & CSS, although a basic. Even if you don't do the coding yourself, understanding how it works will help you design for the web. We've built a comprehensive guide to help you learn CSS. Top courses in CSS and HTML ; Modern HTML & CSS From The Beginning ( Revamp) · Rating: out of · reviews ; Web Design for Beginners: Real World Coding in. CSS · CSS · CSS Typography · CSS Backgrounds & Colors · CSS Effects · CSS Layout · CSS Responsive · CSS Element Styling · CSS References.

Best Residential Real Estate Etf

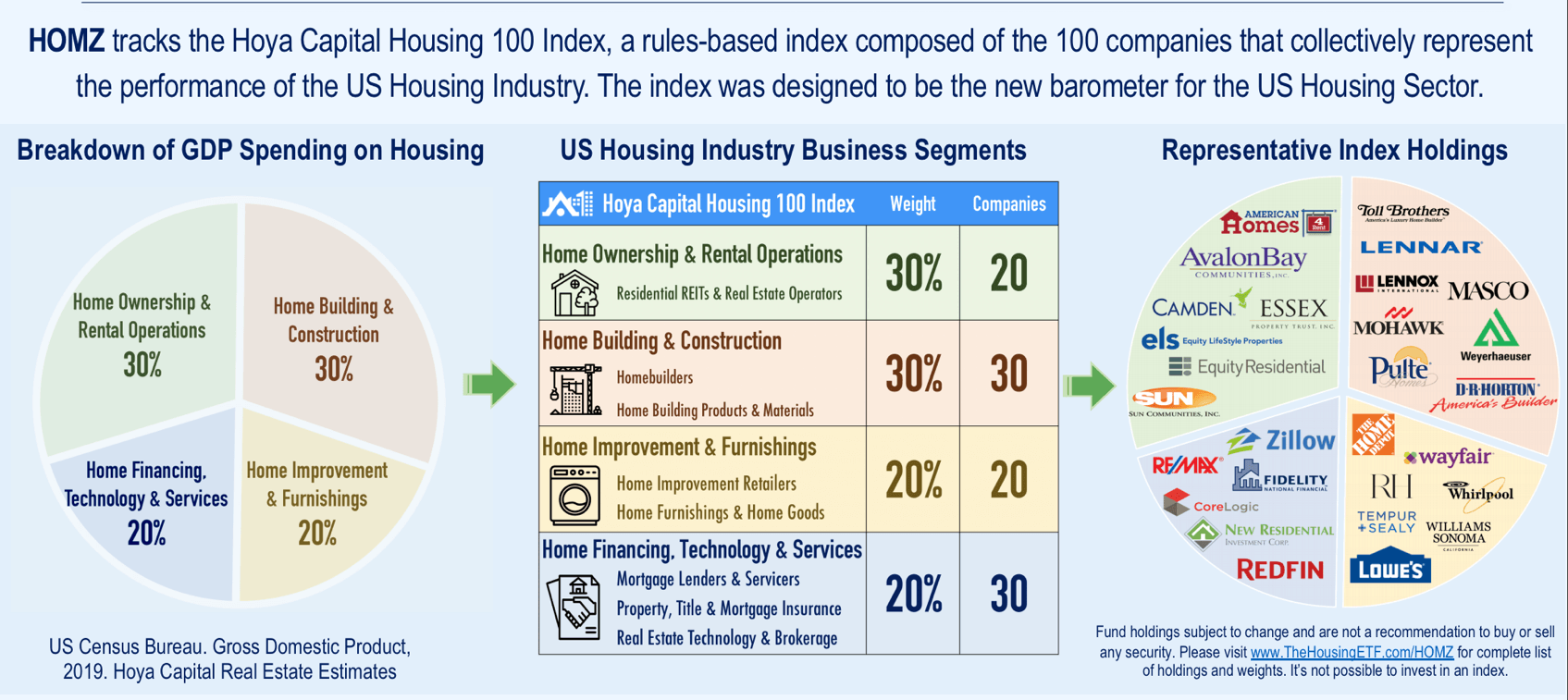

Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. REIT ETF · Real Estate Select. The funds shown here buy shares in REITs, which may own properties such as warehouses, apartment complexes, office buildings, and hotels. ETFs. This is a list of all Residential Real Estate ETFs traded in the USA which are currently tagged by ETF Database. The Index is a measure of the types of global real estate securities that represent the ownership and operation of commercial or residential real estate. This is a list of all Residential Real Estate ETFs traded in the USA which are currently tagged by ETF Database. ETF Benchmarks & Alternatives ; USRT · iShares Core U.S. REIT ETF, % ; BBRE · JPMorgan BetaBuilders MSCI U.S. REIT ETF, % ; VNQ · Vanguard Real Estate ETF. The iShares Residential and Multisector Real Estate ETF seeks to track the investment results of an index composed of U.S. residential, healthcare and. Commercial Real Estate ETFs ; DRV. Direxion Daily MSCI Real Estate Bear 3X Shares. (%). %, $M ; SRS. ProShares UltraShort Real Estate. One notable residential REIT ETF is the iShares Residential Real Estate ETF (REZ). This ETF seeks to track the investment results of an index composed of U.S. Vanguard Real Estate ETF (VNQ): $ billion in assets under management, % in annual expenses, % yield · Schwab U.S. REIT ETF · Real Estate Select. The funds shown here buy shares in REITs, which may own properties such as warehouses, apartment complexes, office buildings, and hotels. ETFs. This is a list of all Residential Real Estate ETFs traded in the USA which are currently tagged by ETF Database. The Index is a measure of the types of global real estate securities that represent the ownership and operation of commercial or residential real estate. This is a list of all Residential Real Estate ETFs traded in the USA which are currently tagged by ETF Database. ETF Benchmarks & Alternatives ; USRT · iShares Core U.S. REIT ETF, % ; BBRE · JPMorgan BetaBuilders MSCI U.S. REIT ETF, % ; VNQ · Vanguard Real Estate ETF. The iShares Residential and Multisector Real Estate ETF seeks to track the investment results of an index composed of U.S. residential, healthcare and. Commercial Real Estate ETFs ; DRV. Direxion Daily MSCI Real Estate Bear 3X Shares. (%). %, $M ; SRS. ProShares UltraShort Real Estate. One notable residential REIT ETF is the iShares Residential Real Estate ETF (REZ). This ETF seeks to track the investment results of an index composed of U.S.

Comparison of the top real estate ETFs in the market · Vanguard Real Estate ETF (VNQ): This ETF aims to track the performance of the MSCI US Investable Market. The iShares U.S. Real Estate ETF seeks to track the investment results of an index composed of U.S. equities in the real estate sector. Best real estate ETFs to watch · iShares UK Property UCITS ETF · WisdomTree New Economy Real Estate UCITS ETF · Invesco S&P Equal Weight Real Estate ETF. Vanguard Real Estate ETF ; Total Net Assets $B ; Beta N/A ; NAV $ ; NAV Date 09/04/24 ; Net Expense Ratio %. #1. The Real Estate Select Sector SPDR® XLRE · #2. iShares Core US REIT ETF USRT · #3. Schwab US REIT ETF™ SCHH · #4. Invesco S&P ® Equal Wt Real Estt ETF RSPR. #1. The Real Estate Select Sector SPDR® XLRE · #2. iShares Core US REIT ETF USRT · #3. Schwab US REIT ETF™ SCHH · #4. Invesco S&P ® Equal Wt Real Estt ETF RSPR. Index-Linked Products ; Capital Dow Jones U.S. Real Estate ETF, ETF, Taiwan, ; DJ US Real Estate, Future, United States, RX. - Intro · - VNQ - Vanguard Real Estate ETF · - VNQI – Vanguard Global ex-U.S. Real Estate ETF · - REET – iShares Global. Real Estate. /. REIT. /. Residential REIT. Residential REIT Dividends Stocks 5 Best Real Estate Dividend Stocks In September. Overview. Payout. Div Growth. Hoya Capital Housing ETF (Ticker: HOMZ) offers diversified exposure across the entire United States residential housing industry, seeking to invest in many of. Real Estate ETFs in comparison ; HSBC FTSE EPRA NAREIT Developed UCITS ETF USD (Acc)IEG6GSP88, 38, % p.a. ; SPDR Dow Jones Global Real Estate UCITS ETF. The SPDR Dow Jones REIT ETF (RWR) is one of the oldest real estate ETFs on the market. The fund tracks a market cap-weighted index of firms involved in the. Vanguard Real Estate ETF (VNQ) is one of the most popular real estate ETFs on the market. It seeks to track the performance of the MSCI US Investable Market. Real estate investment trust (REIT) ETFs are exchange-traded funds (ETFs) that invest the majority of their assets in equity REIT securities and related. Fidelity ETFs ; FREL · Fidelity MSCI Real Estate Index ETF. Real Estate. $ ; FPRO · Fidelity Real Estate Investment ETF. Real Estate. $ Vanguard Real Estate ETF (VNQ) · Invesco KBW Premium Yield Equity REIT ETF (KBWY) · iShares Residential & Multisector Real Estate ETF (REZ) · Nuveen Short-Term. The fund is an actively-managed exchange-traded fund (“ETF”) that seeks to achieve its investment objective by investing in publicly-traded real estate. Research stocks, ETFs, and mutual funds in the Real Estate Sector. We offer more than sector mutual funds and sector ETFs from other leading asset. These may be residential or commercial buildings. International real estate mutual funds and ETFs can be a good investment depending on where property prices. The VanEck REIT ETF invests, amongst others, in REITs, which are tax transparent real estate investment vehicles.

Capital Gains Tax In 2022

Long-Term Capital Gains Tax ; Tax rate, Single, Head of household ; 0%, Up to $40,, Up to $54, ; 15%, $40, to $,, $54, to $, ; 20%. The maximum capital gains tax rate for individuals and corporations · – · % · %. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. Use Schedule D (Form N) to report the sale or exchange of capital assets, except capital gains investment tax credit is excluded from income taxes. Use. - People with high incomes will be subject to a higher capital gains rate of 20%, plus an extra % Net Investment Income Tax (not shown here) as part of the. You'll pay 20% on any amount above the basic tax rate (or 24% on residential property and 28% on carried interest). Example. Your taxable income (your income. A 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. tax). This rule also applies when you report the taxable part of any capital gains reserve you deducted in Do you own a business? If you. How are capital gains taxed? · 22% · $47, – $, · $94, – $, · $47, – $, · $63, – $, Long-Term Capital Gains Tax ; Tax rate, Single, Head of household ; 0%, Up to $40,, Up to $54, ; 15%, $40, to $,, $54, to $, ; 20%. The maximum capital gains tax rate for individuals and corporations · – · % · %. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. Use Schedule D (Form N) to report the sale or exchange of capital assets, except capital gains investment tax credit is excluded from income taxes. Use. - People with high incomes will be subject to a higher capital gains rate of 20%, plus an extra % Net Investment Income Tax (not shown here) as part of the. You'll pay 20% on any amount above the basic tax rate (or 24% on residential property and 28% on carried interest). Example. Your taxable income (your income. A 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. tax). This rule also applies when you report the taxable part of any capital gains reserve you deducted in Do you own a business? If you. How are capital gains taxed? · 22% · $47, – $, · $94, – $, · $47, – $, · $63, – $,

Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. The state income and capital gains tax is a flat rate of %. That has been temporarily reduced to % for the tax year. This income tax reduction can. , Tax Information for Registered Domestic Partners. Purpose. Use California Schedule D (), California Capital Gain or Loss Adjustment, only if there is a. Repeal of Certain Capital Gains Deductions (SF ) and Allowance of Installment Sales (HF ). The amount you pay in federal capital gains taxes is based on the size of your gains, your federal income tax bracket and how long you have held on to the. What will be taxed and when will it go into effect? The new tax applies to capital gains profits from the sale of stocks, bonds, and other non-retirement. For the 20tax years, long-term capital gains taxes range from 0–20% based on your income tax bracket and filing status. The calculator on this page. Beginning January 1, , the tax is 7% of an individual's Washington federal net long-term capital gains, adjusted for exemptions and deductions. It imposes an additional % tax on your investment income, including your capital gains,9 if your modified adjusted gross income (MAGI) is greater than. Generally, the Investment Income Tax for capital gains is 10%. Argentina (Last reviewed 13 May ), Capital gains are subject to the normal CIT rate. That strength helps explain why individual income taxes measured as a share of GDP reached a historical high in fiscal year In CBO's projections, tax. A capital loss carryover from to For more information, see Pub Tax on all taxable income (including capital gains and qualified dividends). Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. Long-term capital gains tax rate is 0%, 15%, or 20% depending on the individual's taxable income and filing status. Long-term capital gains tax rates are. The state income and capital gains tax is a flat rate of %. That has been temporarily reduced to % for the tax year. This income tax reduction can. California imposes an additional 1% tax on taxable income over $1 million, making the maximum rate % over $1 million. The maximum rate for short-term. For the tax year, the 0% rate applies to people with taxable incomes up to $94, for joint filers, $63, for head-of-household filers, and $47, for. Enter the portion of federal gain and loss subject to. Michigan income tax on lines 2, 3, 4, 7, 8, 9 and 10, column E. Section of the Michigan Income Tax. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are Alaska.

1 2 3 4 5 6