loginjoker123.ru

Market

Handyman Code For Schedule C

You should report income from odd jobs as business income on Schedule C (Form ) Profit or Loss From Business. A payer is required to issue you a Form. New Kent County Code (Chapter 66 Article VI. - Business License Taxes) File a Federal Schedule C or Schedule C-EZ "Profit or Loss from a Business. Repairing home and garden equipment--are classified in U.S. Industry , Home and Garden Equipment Repair and Maintenance; · Repairing appliances--are. A sole proprietorship files an Alabama Form 40, with the required attachments including Federal Schedule C or C-EZ, authority of 26 U.S. Code § • North American Industry Classification System (NAICS) code, a federal code that classifies your • Federal Schedule C for sole proprietorships or Schedule E. When improvements are performed or supervised by a contractor, the contract price shall be prima facie evidence of value. Code , § ; , c. ;. A list of business codes can be found by clicking on the button within the Basic Information of the Schedule C. As a proprietor of that business, you should file your independent contractor taxes on a Schedule C (Form ) to properly report your income and claim related. A Schedule C is a form that US-based sole proprietor businesses need to complete to report to the IRS the amount of money they made or lost that year. You should report income from odd jobs as business income on Schedule C (Form ) Profit or Loss From Business. A payer is required to issue you a Form. New Kent County Code (Chapter 66 Article VI. - Business License Taxes) File a Federal Schedule C or Schedule C-EZ "Profit or Loss from a Business. Repairing home and garden equipment--are classified in U.S. Industry , Home and Garden Equipment Repair and Maintenance; · Repairing appliances--are. A sole proprietorship files an Alabama Form 40, with the required attachments including Federal Schedule C or C-EZ, authority of 26 U.S. Code § • North American Industry Classification System (NAICS) code, a federal code that classifies your • Federal Schedule C for sole proprietorships or Schedule E. When improvements are performed or supervised by a contractor, the contract price shall be prima facie evidence of value. Code , § ; , c. ;. A list of business codes can be found by clicking on the button within the Basic Information of the Schedule C. As a proprietor of that business, you should file your independent contractor taxes on a Schedule C (Form ) to properly report your income and claim related. A Schedule C is a form that US-based sole proprietor businesses need to complete to report to the IRS the amount of money they made or lost that year.

As a proprietor of that business, you should file your independent contractor taxes on a Schedule C (Form ) to properly report your income and claim related. Entrepreneurs can deduct on Schedule C a percentage of rent, real-estate taxes, utilities, phone bills, insurance and other costs that are properly allocated to. See 1(c) for additional information on MRRA projects. Yes, a licensed subcontractor should report gross receipts under business code and deduct the amount. Fees Schedule for Permits, Inspections, and Plan Reviews. As of January International Property Maintenance Code; International Residential. To enter a principal business or professional activity code for a Schedule C, go to the Income tab > C Self-Employed Income screen. Ace Handyman Services El Dorado Hills Franchise Owner Chris C. Chris C code where work will be completed now. GET AN ESTIMATE. Get an estimate. First. Any business that files a Schedule C should have an Arlington County Business License. Arlington County Code; Section Code Information(PDF, KB). The IRS considers consulting or contractor income as business income that needs to be entered on a Schedule C. If you have self-employment income from a. Flexible Schedule! Make your own appointments with clients as assigned We are designated tax-exempt under section (c)3 of the Internal Revenue Code. Conquer your to-do list with one consistent handyman and an app to keep you on track. Repair and maintenance. , Drycleaning and laundry services. , Other Investment activities of section (c)(7), (9), or (17) organizations. Code. Investment activities of section. (c)(7), (9), or (17) organizations. Rental of personal property. Passive income activities. SIC Code Handyman Service. The SIC Code List is the Schedule From (Form). Page URL (Long Text). Media Code. CreatedBySystem__c. SF. SIC Code Handyman Service. The SIC Code List is the Schedule From (Form). Page URL (Long Text). Media Code. CreatedBySystem__c. SF. You will need to list your Project Name, Location, and Gross Income on the back of the return (Schedule C). code, or to cause any such work to be done. Below is a list of sixteen business expenses you can claim on your annual Schedule C tax return. Academic Program · Referral Program · API Developer Info. adjust doors, Install/uninstall window a/c units. ➢ Minor plumbing such as replace washers, repair leaking faucets/toilets, open slow drains. ➢ Repairs to. Service on IRS Form , Schedule C and may deduct the cost of the use of a home for business purposes on said Schedule C. (Added by Ord. No. ,, Eff. Below is a list of sixteen business expenses you can claim on your annual Schedule C tax return. Academic Program · Referral Program · API Developer Info. You'll have to file a schedule C. Many of the tools should be considered depreciating assets so you don't get the full value year 1. If you.

How Can You Consolidate Credit Card Debt

What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans. A credit card consolidation loan lets you roll multiple high-interest credit card debts into a single loan with a fixed rate, term and one monthly payment. Debt consolidation is when multiple debts are combined into a single monthly payment. You can choose from a variety of debt repayment strategies. Beware of debt. Combining all your credit card debts into one lump sum can simplify your monthly payments, provide you with a more clear path to becoming debt-free, and. You use this loan to pay off your credit card debt, then repay the loan in monthly installments, usually with a lower interest rate than you were paying on. Consolidate your credit card debt with ease · Check your rate in 5 minutes. · Get funded in as fast as 1 business day. · Combine multiple bills into 1 fixed. Consolidating your debt If you have multiple loans or credit cards, you can combine them all under a new credit application to take advantage of a lower annual. What options exist to consolidate credit card debt? Free expert advice on what to do and managed debt solutions from StepChange, the leading UK debt. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs). What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans. A credit card consolidation loan lets you roll multiple high-interest credit card debts into a single loan with a fixed rate, term and one monthly payment. Debt consolidation is when multiple debts are combined into a single monthly payment. You can choose from a variety of debt repayment strategies. Beware of debt. Combining all your credit card debts into one lump sum can simplify your monthly payments, provide you with a more clear path to becoming debt-free, and. You use this loan to pay off your credit card debt, then repay the loan in monthly installments, usually with a lower interest rate than you were paying on. Consolidate your credit card debt with ease · Check your rate in 5 minutes. · Get funded in as fast as 1 business day. · Combine multiple bills into 1 fixed. Consolidating your debt If you have multiple loans or credit cards, you can combine them all under a new credit application to take advantage of a lower annual. What options exist to consolidate credit card debt? Free expert advice on what to do and managed debt solutions from StepChange, the leading UK debt. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs).

Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with just one monthly payment. You can consolidate multiple. Both balance transfer cards and personal loans are common ways to consolidate debt and can offer different advantages depending on your situation. Simplify your bills with a debt consolidation loan · Check your rate in 5 minutes. · Get funded in as fast as 1 business day.² · Consolidate your bills into 1. Combining multiple loans into one easy-to-manage payment could help you get your finances under control. · If you need help with credit card debt, there are many. TD could help you consolidate your debts and save money by paying off higher-interest credit cards, debt, and credit, with a TD Personal Loan or TD Personal. Simplify your debt by consolidating multiple loans into one The most common debt to consolidate is credit card debt since it typically has some of the highest. Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. Debt consolidation is when you bring your outstanding balances to a single bill and it can be a useful way to manage your debt. How to consolidate credit card debt without hurting your credit With this strategy, you pay off your debts with a debt consolidation loan. This may seem. Is debt consolidation right for you? ; One payment a month at a fixed rate for fixed rate loans. Consolidate debts from other loans and credit cards into one. Estimate what you owe today on your loans, credit cards and lines of credit with the TD Debt Consolidation Calculator. Then, find out when you could be debt. Looking to combine your loans and credit card balances? Let us help you find a debt consolidation loan that's matched to you. Best debt consolidation loans in September ; LightStream: Best for high-dollar loans and longer repayment terms. LightStream · ; Upstart: Best for. This guide helps you understand how credit card consolidation works and how to avoid common pitfalls that can lead to trouble. With a balance transfer credit card, you take your current credit card balance and transfer it to a different card to take advantage of a lower interest rate. Pay off your high-interest credit card debt with a personal loan from PNC. Borrow up to $35K with no collateral required. See current rates and apply today. Getting a debt consolidation loan means you apply for a specific amount of money, usually enough to cover the exact amount of total debt you're trying to pay. Credit card debt consolidation is the act of using a new loan, a new credit card, or a debt management program, to consolidate multiple credit card accounts. A SoFi credit card consolidation loan could help lower monthly payments. · Lower interest rates. Save money by securing a lower fixed APR. · Simplified payments. Should you consolidate your debt? Fill in loan amounts, credit card balances, and other debt to see what your monthly payment could be with a consolidated.

What Is The Current Interest Rate On Heloc

The average rate offered on the LendingTree platform for a $75, HELOC moved from % in April to % in April — about a 13% increase. One way. Current rates range from % to % APR. Closing costs. Bank-paid closing cost options. Potential fees. Overlimit fee of $29; Late fee for 5. Get home equity loan payment estimates with U.S. Bank's home equity loan & home equity line of credit (HELOC) calculator. Check terms and rates today! Get your personalized rate for a Home Equity Line of Credit up to $K Resources to help existing HELOC customers. Questions about your account. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. Fixed rates with % origination fee and no discounts range between % and % APR and are subject to change at any time. Rate offers additional loan. A competitive HELOC rate for most homeowners currently ranges from 8% to 10%. Several factors impact the interest rate such as prime rate, loan repayment term. ¹ HELOC rates start at 9% APR (annual percentage rate), may be as much as % APR and are subject to change at any time. Lowest APR assumes a credit limit of. Take advantage of these interest rate discounts · % · Up to % · Up to % · Low competitive home equity rates — plus. The average rate offered on the LendingTree platform for a $75, HELOC moved from % in April to % in April — about a 13% increase. One way. Current rates range from % to % APR. Closing costs. Bank-paid closing cost options. Potential fees. Overlimit fee of $29; Late fee for 5. Get home equity loan payment estimates with U.S. Bank's home equity loan & home equity line of credit (HELOC) calculator. Check terms and rates today! Get your personalized rate for a Home Equity Line of Credit up to $K Resources to help existing HELOC customers. Questions about your account. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. Fixed rates with % origination fee and no discounts range between % and % APR and are subject to change at any time. Rate offers additional loan. A competitive HELOC rate for most homeowners currently ranges from 8% to 10%. Several factors impact the interest rate such as prime rate, loan repayment term. ¹ HELOC rates start at 9% APR (annual percentage rate), may be as much as % APR and are subject to change at any time. Lowest APR assumes a credit limit of. Take advantage of these interest rate discounts · % · Up to % · Up to % · Low competitive home equity rates — plus.

Interest-Only HELOC Rates ; % · % ; % · %. See today's home equity loan rates from Discover Home Loans. Tap into your home equity with $0 application fees, $0 origination fees, $0 appraisal fees. 18 - Current Rate available on loans for owner-occupied primary residences with loans up to 70% Loan-to-Value (LTV) and credit scores of or higher. Other. Lower Rates: HELOCs typically come with more competitive interest rates (currently about %%), which is materially lower than many personal lines of. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %. Benefits of a HELOC · Convenient access. Access your credit through your TD Access Card, cheques, EasyWeb Online banking and the TD app. · Low interest rate. %. APR · Fixed Rate Advance · Choosing a HELOC from BECU · Features & Benefits · Uses of a HELOC · How HELOCs Work · Fixed Interest-Rate Advance · Frequently. APR is variable and subject to change monthly but cannot exceed 18%, and the APR will never fall below % for HELOC 70%, % for HELOC 80%, % for HELOC. Effective 12/3/, the current variable APR will range from % to %; it will not exceed % APR. Rates apply to new HELOC accounts and may not. The current prime index is %. Minimum interest rate is 3%. Maximum interest rate is 17%. 2 Rate and payments are based on Prime plus a margin. Changes. Rates are as low as % APR and % for Interest-Only Home Equity Lines of Credit and are based on an evaluation of credit history, CLTV (combined loan-to. Current HELOC rates: what to expect ; %. %. %. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. The average home equity loan rate dropped to Learn more: Compare current mortgage interest rates. The Fed has indicated. The rate will never exceed 18% APR, or applicable state law, or below % APR. Choosing an interest-only repayment may cause your monthly payment to increase. Principal-and-Interest Option 7/7, %, % ; Interest-Only Option 10/10, %, %. Current Prime Rate is % as of July 27, Depending on customer's qualifications, variable APR's range for line amounts as stated above. Customer's. Your interest rate and monthly payment may vary over the life of your loan Existing CHELOC customers can consult their Line of Credit Agreement or find their. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. Visit now for home equity financing interest rate, maximum line of credit Your actual Annual Percentage Rate (APR) may be higher than the rates shown.

Where Do Bed Bugs Live During The Day

The total development process from and egg to an adult can take place in about 37 days at optimal temper- atures (>72° F). Adult bed bugs have a life span of. They leave their living spaces during feeding time when they find a host (us humans) close by. Bed bugs detect a live host by sensing CO2 that is expelled. Bed bugs typically hide in cracks and crevices near sleeping areas, such as mattress seams, bed frames, furniture joints, and electrical outlets. Where Do Bed Bugs Hide During the Day? · Sofas and couches · Various pieces of upholstered furniture · Nightstands · Dressers · Electrical outlet covers · Behind. They can be found hiding in mattress seams, box springs, in the bed frame, carpets and other furniture. Bed bugs can travel an astonishing 20 feet from their. After a bed bug feeds, it swells up into a red balloon to almost three times its normal size; hence, bed bugs cannot survive on a human body or live discreetly. Bed bugs cannot fly. Bed bugs hide during the day in dark, protected sites. They seem to prefer fabric, wood, and paper surfaces. They usually occur in fairly. Bed bugs hide during the day in dark, protected areas. Bed bugs can not travel far. They are transported by humans by latching on to luggage, clothing. Live bugs – Bed bugs will hide in areas such as the seams or tags of mattresses and box springs, screw holes on the headboard joints, along bed frames, and in. The total development process from and egg to an adult can take place in about 37 days at optimal temper- atures (>72° F). Adult bed bugs have a life span of. They leave their living spaces during feeding time when they find a host (us humans) close by. Bed bugs detect a live host by sensing CO2 that is expelled. Bed bugs typically hide in cracks and crevices near sleeping areas, such as mattress seams, bed frames, furniture joints, and electrical outlets. Where Do Bed Bugs Hide During the Day? · Sofas and couches · Various pieces of upholstered furniture · Nightstands · Dressers · Electrical outlet covers · Behind. They can be found hiding in mattress seams, box springs, in the bed frame, carpets and other furniture. Bed bugs can travel an astonishing 20 feet from their. After a bed bug feeds, it swells up into a red balloon to almost three times its normal size; hence, bed bugs cannot survive on a human body or live discreetly. Bed bugs cannot fly. Bed bugs hide during the day in dark, protected sites. They seem to prefer fabric, wood, and paper surfaces. They usually occur in fairly. Bed bugs hide during the day in dark, protected areas. Bed bugs can not travel far. They are transported by humans by latching on to luggage, clothing. Live bugs – Bed bugs will hide in areas such as the seams or tags of mattresses and box springs, screw holes on the headboard joints, along bed frames, and in.

Night Life. Bed bugs are mainly active at night as this is when they feed. If you think about it, this makes sense. Bed bugs feed on. Yeah we've pretty much only found stragglers during the day. never at night. Our situation is from an infestation at our neighbors apartment. • Bed bug bite reactions can take a few minutes or as many as 14 days to appear. Treatment of a living area for bed bugs should focus on containment of the. When bed bugs are not feeding, they hide in places far away from human sight. These areas provide them with shelter while they sleep in the morning while. Bed bug hiding places can also include clothing and linens, under clutter, in wall voids, and around window and door moldings. Once inside, bed bugs live in mattresses, furniture, cracks and crevices, and clothing. During the day, these tiny reddish-brown insects tend to hide close to. Where do bed bugs hide? Bed bugs like tight, dark areas to hide in during the day. They have been found in all manner of places, including mattress seams. While it's true that bed bugs prefer to hide in the cracks and crevices of beds and mattresses, sometimes bed bugs move around during the day as well. In this. They latch onto suitcases, clothes, and linens and can end up wherever these items are taken. This is why the spread of bed bugs occurs so easily. It's often. Nightstands and dressers are large enough, with plenty of crevices, for bed bugs to hide in during the daytime or when they consider the mattress to be unsafe. The most commonbed bug hiding places involve the actual bed or bedding. Some common areas that need to be checked near the bed include: on sheets and comforters. Bed bugs can live in almost any crevice or protected location. The most common place to find them is beds or areas where people rest or sleep. This is. For bed bugs the ideal environment would be a place where food is always available and the temperature is always between 65° and 85° F. The bedroom of most. They crawl away and hide during the day. They know when you're asleep, something to do with the changes in the carbon dioxide levels in the air. Where Else Bed Bugs are Found? · Hotels/Motels - 68 percent · Nursing Homes – 59 percent · Schools & Day Care Centers – 47 percent · Office Buildings – 46 percent. They come out at night. They do not fly or jump, but they can crawl rapidly. How can bed bugs get into my home? They can. The bed is the first place you should inspect. Bed bugs like to stay near their host, so you should expect to find them in various places on your bed. It would. Bed bugs usually feed at night but can take a blood meal during the day, especially in heavily-infested areas. They usually require minutes to engorge. Bed bugs are so named because they are nocturnal and thrive best in beds where people sleep. During the day, they hide in crevices, bed frames, mattresses. Bed bugs are typically much more active at night. They prefer human blood and require feeding to be able to mate and breed. They won't go too far during the day.

Quick And Easy Loans Today

Need a little extra cash? Check out this quick, $, no credit check loan for qualifying members. Just a few minutes and you're ready to dive into fun! online payday loan with instant funding to an eligible debit card in California today. From Hollywood to Napa Valley, we deliver quick loans online. Need cash fast? Get the cash you need with our quick online installment loans. Fast, convenient, confidential, and secure. No hidden fees. Kentucky Online Loans: CC Flow Line of Credit Powered by Advance Financial. Line of credit loans for when you need cash fast. Login Get Cash Now**. afAF Be approved for an online loan up to $3, in minutes. Have cash in your bank account as soon as today.*. First Name. In the state of Wisconsin, Wise Loan offers loan amounts between $ and $ You don't necessarily need to have good credit to be approved for a Wise Loan! You could get funding today with these quick cash loans · LightStream: Best for home improvement emergencies · SoFi: Best for large loans · Rocket Loans: Best for. Need $ quick cash? At Power Finance Texas we'll get your $ on the spot when you apply for a cash advance loan today! Online cash loans from loginjoker123.ru are a great way to get the cash you need quickly, easily and on your own terms. Need a little extra cash? Check out this quick, $, no credit check loan for qualifying members. Just a few minutes and you're ready to dive into fun! online payday loan with instant funding to an eligible debit card in California today. From Hollywood to Napa Valley, we deliver quick loans online. Need cash fast? Get the cash you need with our quick online installment loans. Fast, convenient, confidential, and secure. No hidden fees. Kentucky Online Loans: CC Flow Line of Credit Powered by Advance Financial. Line of credit loans for when you need cash fast. Login Get Cash Now**. afAF Be approved for an online loan up to $3, in minutes. Have cash in your bank account as soon as today.*. First Name. In the state of Wisconsin, Wise Loan offers loan amounts between $ and $ You don't necessarily need to have good credit to be approved for a Wise Loan! You could get funding today with these quick cash loans · LightStream: Best for home improvement emergencies · SoFi: Best for large loans · Rocket Loans: Best for. Need $ quick cash? At Power Finance Texas we'll get your $ on the spot when you apply for a cash advance loan today! Online cash loans from loginjoker123.ru are a great way to get the cash you need quickly, easily and on your own terms.

A payday loan is a small-dollar, instant, unsecured financing option that is designed to tide you over until your next payday with fast cash. They are usually. Apply For A Loan Today. Quick and easy applications for quick loans. Complete your application in just a few minutes. Provide your digital signature with. We know things don't always go according to plan—that's why we make repaying your loan simple, straightforward, and much more affordable than predatory payday. No credit check required · Must be 18 years old and a Member for at least 9 months · Quick, easy online application with instant approval · Upon approval, we. LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. An emergency payday loan from Cashback Loans is ideal for unplanned expenses as approval nearly instant in most cases, providing you with the money you need. Get instant loans with our trusted lenders. We offer personal loans that you can apply for online and quickly receive the money in your bank account. If you have a Blue Eagle Credit Union account already, make an appointment or apply online today. If you do not already have an account with us, check our. Installment cash loans are fast and easy loans online that put the money you need now in your bank account as soon as possible. When you get approval, you get. Apply For A Loan Today. Quick and easy applications for no credit check loans. Complete your application in just a few minutes. Provide your digital. Apply for an online payday loan today from Speedy Cash and get a lending decision in minutes. If approved, you could get INSTANT cash to your debit card. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Get online loans with same-day approval and next day funding. Simple Fast Loans offers quick cash advance and easy personal installment loans online. Apply online for a Florida installment loan with ACE Cash Express. The application process is simple, and - if approved - you may receive funds quickly. Ohio loans from Check City are quick and convenient, so you can get the fast financial solutions you need today. Apply Now Login Not from Ohio? Click here for. Fast, Friendly & Easy Cash Loans. Unexpected emergency? Surprise bill? Get up to $4,* with a Flex Loan. security Apply Now. Apply for an emergency loan online from $1, - $20, This won't affect your credit score. What you get with every OneMain personal loan for emergencies. Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time. A quick cash installment loan from Wise Loan can get you the cash you need into your checking account, in some cases as soon as the same day! Easy and hassle-free application process · No hidden charges · No long waiting period · Anyone, even those with bad or non-existent credit can qualify · Fast same.

What Is Good Car Loan Interest Rate

Best Auto Loan Rates & Financing in Compare Lenders ; LightStream - New car purchase loan. · % · $5,$, · ; Consumers Credit Union -. A good used car loan depends on your credit score, and where you acquire the loan from. Learn more with the team at Suntrup Automotive Group! As of , the average interest rate for car loans was percent for new cars and percent for used cars. Average Used Auto Loan Rate for Good Credit. Credit Score, Interest Rate. , %. Interest rates are an important part of your car loan. Figure out what a good interest rate is for your car loan with Mercedes-Benz of Portland below! What is a good car loan rate? That depends on your credit score, with the average interest rate on a new car loan being between 3 and 14 percent. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. What is a good car loan rate? This varies depending on your credit score and where you're getting the loan at. Explore our chart to see what is the average. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision. Best Auto Loan Rates & Financing in Compare Lenders ; LightStream - New car purchase loan. · % · $5,$, · ; Consumers Credit Union -. A good used car loan depends on your credit score, and where you acquire the loan from. Learn more with the team at Suntrup Automotive Group! As of , the average interest rate for car loans was percent for new cars and percent for used cars. Average Used Auto Loan Rate for Good Credit. Credit Score, Interest Rate. , %. Interest rates are an important part of your car loan. Figure out what a good interest rate is for your car loan with Mercedes-Benz of Portland below! What is a good car loan rate? That depends on your credit score, with the average interest rate on a new car loan being between 3 and 14 percent. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. What is a good car loan rate? This varies depending on your credit score and where you're getting the loan at. Explore our chart to see what is the average. Find the best car loan by comparing rates from multiple lenders and learn everything you need to know about an auto loan before you make a decision.

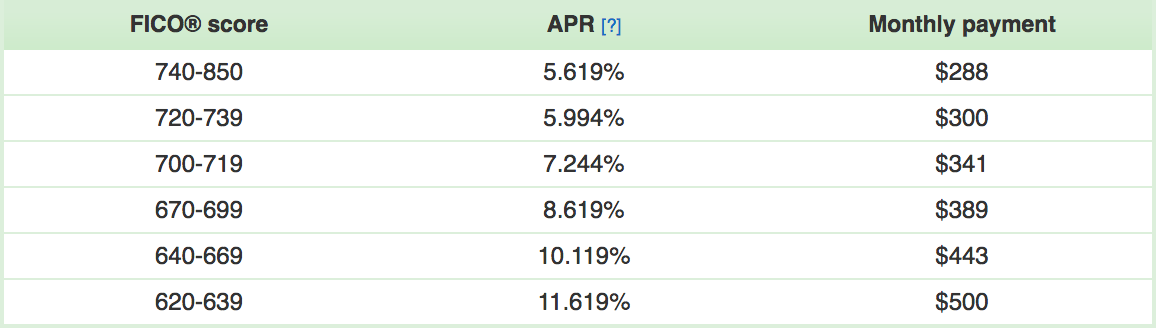

What is a good interest rate for a car loan? Don Ringler Toyota covers the basics of car loan interest rates that Temple drivers can expect! What is a good interest rate for a car loan? Advantage Nissan looks a few determining factors and gives you tips on how to make sure you're getting a solid. A good car loan interest rate depends on where you're trying to obtain the loan and your credit score. Find out what a good car loan rate is with Major. Are you wondering what is the average interest rate on a car loan? Get the details about what is a good car loan rate from the finance experts at Galaxy. percent is pretty much free money, and percent is okay. I think looking at the fed rate and adding 1 to 2 percent would be an okay rate. If you have decent credit in the US today think about 4 to 5% APR on a RECENT model used car. If your question is “I will pay 28% TOTAL,” over. Get the car you want with Mountain America's help. Finance your car purchase with an auto loan from Mountain America Credit Union. Lock in a great loan rate. Have you been wondering what is considered a good interest rate for your car loan?Let the experts at Temecula Valley Toyota help! Explore average used car interest rates and new car interest rates by credit score with Leson Chevrolet Company, Inc. and start planning for your next car. What is a good car loan rate depends on the length of the car loan, whether the car is new or used, your credit score, and which lender is offering you the. Average Auto Loan Rates for Excellent Credit · or higher, % ; Average Auto Loan Rates for Good Credit · , % ; Average Auto Loan Rates for Fair. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. Are you thinking about financing a new Subaru or other vehicle and are curious what is a good interest for a car loan? Santa Cruz Subaru can help. The best rates for an auto loan can vary significantly, depending on your credit score. (For example, anywhere from % to % for a new vehicle and %. According to Experian's State of the Automotive Finance Market report, the average auto loan interest rate for new cars in 's second quarter was Rates as of Sep 05, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. The answer will depend primarily on your credit. Those with great credit may be able to get a car loan rate between 3% and 4%. However, an average interest rate on a car loan for people with bad credit has been %. What Is a Good Interest Rate on a Car Loan? Of course, the lower. What qualifies as a good interest rate for a car loan is dependent upon many factors, like credit score and lender. See our rate chart to see your estimated.

What Is A Leveraged Buyout

What is a Leveraged Buyout (LBO)?. A leveraged buyout is a financial transaction in which a PE firm acquires a company primarily using borrowed funds, with the. A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition. A leveraged buyout (LBO) is a transaction where a business is acquired using debt as the main source of consideration. Put simply, the answer to the question: What is a leveraged buyout? It's when a company is bought out and the buyer uses money that is largely from loans to pay. Your Guide to an Effective Leveraged Buyout · 1. Determine the Cost. It is important to determine what the maximum purchase price is based on leverage levels. Introduction. A leveraged buyout, or LBO, is an acquisition of a company or division of another company financed with a substantial portion of borrowed. A leveraged buyout (LBO) occurs when the buyer of a company takes on a significant amount of debt as part of the purchase. The buyer will use assets from the. Corporations frequently use debt when acquiring other companies; the acquisitions become leveraged buyouts (LBOs) when borrowed money accounts for a significant. Definition. A leveraged buyout (LBO) is a takeover of a company that is financed, in whole or in part, with borrowed money. Partial debt financing allows the. What is a Leveraged Buyout (LBO)?. A leveraged buyout is a financial transaction in which a PE firm acquires a company primarily using borrowed funds, with the. A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition. A leveraged buyout (LBO) is a transaction where a business is acquired using debt as the main source of consideration. Put simply, the answer to the question: What is a leveraged buyout? It's when a company is bought out and the buyer uses money that is largely from loans to pay. Your Guide to an Effective Leveraged Buyout · 1. Determine the Cost. It is important to determine what the maximum purchase price is based on leverage levels. Introduction. A leveraged buyout, or LBO, is an acquisition of a company or division of another company financed with a substantial portion of borrowed. A leveraged buyout (LBO) occurs when the buyer of a company takes on a significant amount of debt as part of the purchase. The buyer will use assets from the. Corporations frequently use debt when acquiring other companies; the acquisitions become leveraged buyouts (LBOs) when borrowed money accounts for a significant. Definition. A leveraged buyout (LBO) is a takeover of a company that is financed, in whole or in part, with borrowed money. Partial debt financing allows the.

A leveraged buyout is a financial transaction in which a company is purchased with a combination of equity and debt. Leveraged Buyout or LBO is when a company is purchased using the purchased company's assets & cash flow to acquire a loan to buy the company. What Is a Leveraged Buyout? A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money to meet the cost of. This program is designed to help finance and investment professionals attain a comprehensive understanding of leveraged buyouts and the process of. A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of. Leveraged buyout definition: the purchase of a company with borrowed money, using the company's assets as collateral, and often discharging the debt and. In this guide, we'll discuss the most common types of leveraged buyout financing, what to consider during the planning process, and how to pick the right. Get an LBO Edge with Vantage Bank. There is always opportunity in the mergers and acquisitions landscape. Whether you're a buyer or seller, this might be the. LEVERAGED BUYOUT meaning: 1. an occasion when a small company buys a larger one using money borrowed against the value of the. Learn more. In numerous cases, leveraged buyouts (LBOs) have been used by managers to buy out shareholders to gain control over the company, and the strategy played an. A leveraged buyout is done where you don't have, or don't want to spend, enough money to buy that controlling stake. A leveraged buyout (LBO) involves the acquisition of a company through outside capital from a lender. A typical LBO can be divided into four separate. LBO, an acronym for “leveraged buyout”, refers to the acquisition of a company using a significant amount of debt, which can be in the form of bank loans, 2nd. Summary: A leveraged buyout, commonly called an LBO, is a type of financial transaction used to acquire a company. Leveraged buyouts combine substantial. With an LBO, a buyer does not have to use a significant amount of their own money. Nor do they have to raise large sums or borrow from private investors. A leveraged buyout is the acquisition of a company, either privately held or publicly held, as an independent business or from part of a larger company. The debt is secured by the target's assets, future cash flow or some combination. In a typical LBO, a private equity fund pays a portion of the purchase price. In a leveraged buyout, the PE fund usually creates a new entity, Newco, which is the entity that acquires the target company. The Newco borrows from the lead. An LBO is more like buying a house to rent out to tenants ie an asset that you earn cash flow from, as opposed to a place to live in yourself.

Youtube How Much Can You Earn

The average payment for each individual video is $3-$5 per 1, views. Practically speaking, you get paid $$ per one view. Your earnings from YouTube Memberships can vary a lot, depending on factors like your audience size, subscriber loyalty, and the membership prices you set. In , on average, we earned $ a month from our YouTube channel, Days We Spend. And I think that's great for a channel with 12k subscribers. Vlogging on YouTube can be lucrative even for middleweight creators, with one-million-subscriber channels thought to earn about $5, in ad revenue per. YouTube's ad revenue sharing model equally splits the revenue between creators and music publishers, so if you have one song in your video, you're both paid 50%. YouTubers make money through advertisements. It does not matter how many videos your video itself has or how many subscribers you have. You will not receive. General Estimate: YouTube pays between $1, to $3, for 1 million views. Niche Differences: High-value niches like finance. YouTube Creators are individuals who produce content for the platform. This is a unique model that empowers Creators to earn money directly on our platform. Earn ad revenue from display, overlay, and video ads that run on your channel. With YouTube Premium, you can earn a portion of a subscriber's fee when they. The average payment for each individual video is $3-$5 per 1, views. Practically speaking, you get paid $$ per one view. Your earnings from YouTube Memberships can vary a lot, depending on factors like your audience size, subscriber loyalty, and the membership prices you set. In , on average, we earned $ a month from our YouTube channel, Days We Spend. And I think that's great for a channel with 12k subscribers. Vlogging on YouTube can be lucrative even for middleweight creators, with one-million-subscriber channels thought to earn about $5, in ad revenue per. YouTube's ad revenue sharing model equally splits the revenue between creators and music publishers, so if you have one song in your video, you're both paid 50%. YouTubers make money through advertisements. It does not matter how many videos your video itself has or how many subscribers you have. You will not receive. General Estimate: YouTube pays between $1, to $3, for 1 million views. Niche Differences: High-value niches like finance. YouTube Creators are individuals who produce content for the platform. This is a unique model that empowers Creators to earn money directly on our platform. Earn ad revenue from display, overlay, and video ads that run on your channel. With YouTube Premium, you can earn a portion of a subscriber's fee when they.

You can earn money on YouTube by applying for and being accepted to the YouTube Partner Program. Only channels that follow our YouTube channel monetization. The typical YouTube's RPM range is between $ to $ The actual RPM value will depend on your monetization tier. Your monetization tier is largely by your. However, top YouTubers in India can earn much more than that, with some earning an average of Rs. lakhs per 1 lakh views. Creators can earn money through ad. Revenue. Earnings will vary, but crossing the threshold of $ to $1, per month is often considered a sign of a potentially sustainable income from YouTube. It is estimated that creators earn between $ and $ per view or $18 per 1, views. While that doesn't sound like much, marketing revenue can add up. Do you enjoy watching YouTube videos in your spare time? “Choose a job These platforms don't set strict rules regarding how much you can earn. You. How much does YouTube pay for 1 million views? Statistic. You can expect to be paid between $2, and $3, in ad revenue for 1 million YouTube views. Source. Where can I view my earnings? YouTube Analytics. You can check your estimated YouTube revenue by using YouTube Analytics. Sign in to YouTube Studio. From the. This opens up the opportunity to earn money from ads and other monetization methods. Reaching k subscribers is another milestone that allows. Whipped Cream Sounds blog estimates that, depending on your location, you can earn on average $ per stream, or around $6-$8 for 1, The revenue a creator can earn per ad view is variable, with an average rate of about $ per ad view, as reported by Influencer Market Hub. YouTube Creators are individuals who produce content for the platform. This is a unique model that empowers Creators to earn money directly on our platform. You can utilize a YouTube money calculator to assess your total subscriber count and observe how it impacts your video views, thereby increasing your total. To this question, we can answer both yes and no. On average, YouTube pays between $ and $ per view. For 1 million views, you can expect to earn. How much does a Youtube Channel make? As of Sep 3, , the average annual pay for a Youtube Channel in the United States is $68, a year. Just in case you. Note: The accepted formula that Social Blade LLC uses to calculate the CPM range is $ USD - $ USD. The range fluctuates this much because many factors. You can utilize a YouTube money calculator to assess your total subscriber count and observe how it impacts your video views, thereby increasing your total. Once you qualify for monetization, YouTube takes a 45% cut from ad revenue. Generally speaking, YouTubers generate around $18 per 1, ad views—or between $3. Note: The accepted formula that Social Blade LLC uses to calculate the CPM range is $ USD - $ USD. The range fluctuates this much because many factors. YouTube Key Statistics · YouTube generated $ billion revenue in , a % increase year-on-year · Over billion people access YouTube once a month.

How Does Life Insurance Build Cash Value

A cash value life insurance policy offers a death benefit plus a cash component that builds in value. Find out how it can be a life-long asset. Basically, the insurance broker will use a portion of the fees to buy a series of term life insurance policies on you to pay out in the event. A portion of your premium goes toward the cash value of your policy. Consistently paying your premium contributes to the cash value's growth over time. Many. The cash value in life insurance is simply what your policy is worth. It provides a savings component for the policy owner, and maintains a guaranteed rate. Life insurance policies that build cash value can be complex, but many allow the policyholder to borrow against the policy or to withdraw cash permanently (a ". While term life insurance can be a useful policy for many people, it doesn't build cash value. With this type of policy, you pay for a potential death benefit. With cash value life insurance, a portion of every premium payment goes toward a savings feature that collects interest over time. Please Note: VALife does not offer waiver of premiums. Here are the The cash value builds over the life of the policy and is available for use. Life insurance with cash value is a type of permanent policy that can build funds over time through the cash value component. A cash value life insurance policy offers a death benefit plus a cash component that builds in value. Find out how it can be a life-long asset. Basically, the insurance broker will use a portion of the fees to buy a series of term life insurance policies on you to pay out in the event. A portion of your premium goes toward the cash value of your policy. Consistently paying your premium contributes to the cash value's growth over time. Many. The cash value in life insurance is simply what your policy is worth. It provides a savings component for the policy owner, and maintains a guaranteed rate. Life insurance policies that build cash value can be complex, but many allow the policyholder to borrow against the policy or to withdraw cash permanently (a ". While term life insurance can be a useful policy for many people, it doesn't build cash value. With this type of policy, you pay for a potential death benefit. With cash value life insurance, a portion of every premium payment goes toward a savings feature that collects interest over time. Please Note: VALife does not offer waiver of premiums. Here are the The cash value builds over the life of the policy and is available for use. Life insurance with cash value is a type of permanent policy that can build funds over time through the cash value component.

Because of these features, cash value life insurance generally has higher premiums. What is death benefit and why is it important? The policy's essential elements consist of the premium payable each year, the death benefits payable to the beneficiary and the cash surrender value the. Cash value life insurance combines a death benefit with a savings or investment component, providing both protection and a financial asset. The cash value savings account and dividends with a whole life insurance policy grow based on the calculations provided by the insurance company, which are. Life insurance cash value is the portion of your policy that accumulates over time and may be available for you to withdraw or borrow against. Cash value life insurance is an umbrella term used to describe a life insurance policy that can build cash value over time. The cash value grows tax-deferred and can be accessed during your lifetime through withdrawals or loans As the investments grow, so does the cash value of. You can adjust the policy, and even the amount you pay, as your life changes, but that will cause the death benefit to fluctuate. Building cash value. When you. Think of it as an insurance policy with a saving account-like component. Your cash value will accumulate over time at a minimum guaranteed rate indicated by. Universal life insurance is also referred to as "flexible premium adjustable life insurance." It features a savings element (cash value) that grows on a tax-. Whole life policies are one of the few life insurance plans that build cash value. What is whole life insurance cash value? It is generated when premiums are. How Cash Value Life Insurance Works The cash value of life insurance earns interest, and taxes are deferred on the accumulated earnings. While premiums are. Some types of permanent life insurance policies, such as whole life or universal life, have a cash value feature in addition to the death benefit. Part of your. Cash value: In most cases, the cash value portion of a life insurance policy doesn't begin to accrue until years have passed. Once cash value begins to. With both whole life and universal life, the actual amount of cash value you build will vary based on the specific terms of your policy. How to access your cash. With whole life insurance, unlike term, you build guaranteed cash value. Cash Value Money that grows in your policy that you can access while you're still alive. A whole life insurance policy will begin building cash value as soon as you pay your first premium, and it will continue building throughout the life of the. The money you may be able to get while you're alive and well comes from what is known as your policy's “cash value.” But not every life insurance policy builds. It generates interest or market returns. How long does it take to build cash value on life insurance? Cash value on a life insurance policy often accumulates.

What Can I Buy To Remove Skin Tags

Place a bandage over the cotton ball to keep it in place for minutes. Remove and wash the area. Do this daily until the skin tag falls off. It may take a. Get the best deals on Skin Tag Wart Remover for your home salon or home spa. Relax and stay calm with loginjoker123.ru Fast & Free shipping on many items! Yes, Claritag can treat skin tags on any skin shade. Its tweezer-like heads target just the tag, avoiding the surrounding skin. Shop Target for Skin Treatments you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Then, an iris scissors is used to remove the lesion below the base of the stalk. In most cases, this will keep the lesion from recurring. Once the skin tag has. The Internet is full of at-home skin tag removers. However, many of these treatments, while they do remove your skin tags, can also cause. Dr. Scholl's Freeze Away Skin TAG Remover, 8 Ct // Removes Skin Tags in As Little As 1 Treatment, FDA-Cleared, Clinically Proven, 8 Treatments. Do not try to remove a skin tag yourself unless a GP recommends it. Risks include infection, bleeding and scarring. Causes of skin tags. The cause of skin tags. Everlom Micro Skin Tags Remover Kit: The ALL-IN-ONE Micro skin tag remover set includes 36 skin tag repair patches, 24 micro bands, 12 cleansing wipes,1 micro. Place a bandage over the cotton ball to keep it in place for minutes. Remove and wash the area. Do this daily until the skin tag falls off. It may take a. Get the best deals on Skin Tag Wart Remover for your home salon or home spa. Relax and stay calm with loginjoker123.ru Fast & Free shipping on many items! Yes, Claritag can treat skin tags on any skin shade. Its tweezer-like heads target just the tag, avoiding the surrounding skin. Shop Target for Skin Treatments you will love at great low prices. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Then, an iris scissors is used to remove the lesion below the base of the stalk. In most cases, this will keep the lesion from recurring. Once the skin tag has. The Internet is full of at-home skin tag removers. However, many of these treatments, while they do remove your skin tags, can also cause. Dr. Scholl's Freeze Away Skin TAG Remover, 8 Ct // Removes Skin Tags in As Little As 1 Treatment, FDA-Cleared, Clinically Proven, 8 Treatments. Do not try to remove a skin tag yourself unless a GP recommends it. Risks include infection, bleeding and scarring. Causes of skin tags. The cause of skin tags. Everlom Micro Skin Tags Remover Kit: The ALL-IN-ONE Micro skin tag remover set includes 36 skin tag repair patches, 24 micro bands, 12 cleansing wipes,1 micro.

Skin tags may be removed with a scalpel or surgical scissors. Freezing it with liquid nitrogen. Your doctor will swab or spray a small amount of super-cold. Arrow Product details CRYOTAG is the home-use skin tag remover that allows you to remove irritating or unsightly skin tags quickly & effectively, leaving you. Shop for Freeze Away Skin Tag Remover (Pack of 2) (2 packs) at Fred Meyer. Find quality health products to add to your Shopping List or order online for. How can you care for yourself at home? If you have a skin tag removed, clean the area with soap and water two times a day unless your doctor gives you. You can remove skin tags with surgical options including cryosurgery. Some at-home remedies and over-the-counter products may help skin tags dry out and fall. Tea tree oil has been found to help to get rid of skin tags. People who try it apply a few drops of the oil to a cotton ball, which they affix to the skin tag. Tie off the skin tag at the base. If your skin tag is small and has a narrow base, you may be able to get rid of it by tying it off with dental floss or thin. Shop for Dr. Scholl's® Freeze-Away® Skin Tag Remover (8 ct / oz) at Kroger. Find quality health products to add to your Shopping List or order online. Apply 3 times daily to aftected area. Skin tags will dry and flake away over a several week period. Some individuals may be sensitive to essential oil. Dr. Scholls® Freeze Away® Skin Tag Remover is the first over-the-counter FDA cleared technology for skin tag removal so you can remove embarrassing skin. Dr. Scholl's® Freeze Away® Skin Tag Remover is the first over-the-counter FDA cleared technology for skin tag removal – so you can remove embarrassing skin. Shop for Skin Tag Remover at loginjoker123.ru Save money. Live better. Skin tags are considered to be harmless but they can become irritated if anything rubs on them. Dr. Scholl's® Freeze Away® Skin Tag Remover instantly freezes. Get the best deals on Skin Tag Remover for your home salon or home spa. Relax and stay calm with loginjoker123.ru Fast & Free shipping on many items! The Tag Away Skin Tag Remover has an all-natural special formula to prevent this. It contains natural plant extracts that remove unwanted skin growths without. INSTANT RESULTS: Scholl's at-home skin tag remover safely and completely removes skin tags in as little as 1 treatment. CLINICALLY PROVEN: Skin tags are. The Rite Aid Skin Tag Remover Stick is % natural and easy to apply, plus its convenient stick design targets skin tags and eliminates them quickly and. However although they can be harmless they can be unsightly and many people choose to have them removed if they become irritated or cause discomfort however. FREE PDF: Top 25 Home Remedies That Really Work loginjoker123.ru Find out how to get rid of skin tags fast using a simple. Although this skin tag remover method may cause a blister, it will eventually go away on its own. Burning it off. Another effective method of getting rid of.

1 2 3 4 5 6